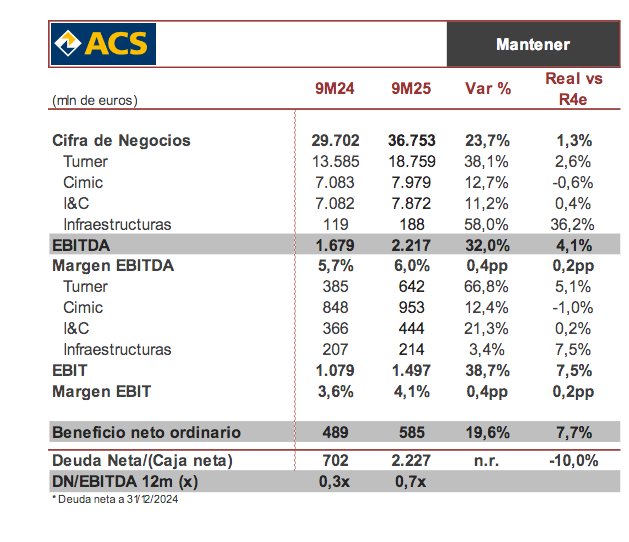

Renta 4 | Sales figures, which exceeded our forecast, show significant growth in all areas, led by Turner and Infrastructure. EBITDA, also better than our expectations, shows higher growth than sales, thereby significantly improving margins. This improvement is reflected in ordinary net profit which, excluding the currency effect, accelerates growth to 23.8%.

This strong improvement has led the company to raise its guidance for the end of the year, expecting growth of 25% versus 17% at the upper end of the previous target range, 12% Renta 4 estimate and 17% FactSet consensus. In the case of net debt, the trend is better than expected, mainly as a result of higher operating cash flow.

If we analyse each of the divisions: Turner: we are improving our sales forecast thanks to organic growth of 35.5% driven by the data centre, healthcare, biopharma and education sectors, as well as the contribution of Dornan Engineering (electromechanical engineering acquired in 2024) with a margin slightly better than our forecast.

Cimic is in line with our forecast, reflecting, as in previous results, the greater contribution from the consolidation of Thiess, showing stability on a comparable basis.

Engineering and Construction has improved its sales forecasts, growing thanks to the contribution of segments such as data centres and high-speed transport. In the case of infrastructure, Iridium’s contribution to sales shows excellent performance, exceeding our forecast, while in the case of Abertis, the contribution is below what we were expecting, due to slightly lower than expected traffic, with EBITDA growth of 0.5% (versus 3% Renta 4 estimate).

Strong level of awards allows the portfolio to increase by 8.9% to €89.3 billion (in line with 1H). Focus on high-growth markets, mainly in digital infrastructure, defence and biopharma markets. Excellent positioning to take advantage of infrastructure investment in Germany.

Although we believe the share price is trading at demanding levels in the short term, we continue to believe there is long-term growth potential thanks to its excellent geographical and operational positioning. At Turner, growth is expected in advanced technology projects in both the US and Europe (recent acquisitions to improve capabilities), with margins improving to 3.5% in 2026 from 3% in 2024. Cimic is positioned to grow in energy transition, sustainable mobility, data centre and defence projects. In Engineering and Construction, there are good growth prospects in civil engineering and building construction derived from infrastructure investment plans in Germany, as well as cross-selling opportunities and value creation from the new investment momentum in greenfield projects with excellent positioning to continue winning managed lane contracts in the United States after the award of the SR-400, and growth opportunities from the high-tech and defence portfolio. Selective acquisitions in brownfield infrastructure through Abertis. All this while maintaining an attractive shareholder remuneration policy. We reiterate our hold rating and are reviewing our target price (previously €60).