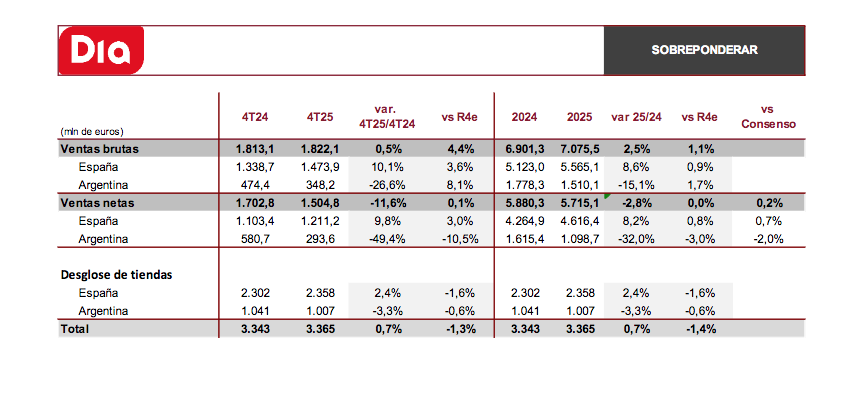

Renta 4 | The supermarket chain has published its preliminary sales figures for Q4 2025, in line with our estimates and those of the consensus, reporting a 6% year-on-year drop in net sales, showing strength in Spain, with a reported 10% year-on-year increase, while in Argentina it reached 26% year-on-year due to the strong impact of the currency.

The results in Spain continue the positive trend seen throughout the rest of the year, showing solid growth of 7.7% year-on-year in comparable gross sales (LfL), supported by a 5.6% year-on-year increase in sales volume, driven by an expanding customer base and increased frequency of store visits, confirming once again the success of the Company’s proximity strategy and value proposition. During Q4 2025, it opened 36 new stores, bringing the total number of openings for the year to 94. This investment more than offset the implementation of the network optimisation plan, which involved the closure of 38 stores during the year.

According to Nielsen IQ data, the company increased its market share by 20 basis points in 4Q25 compared to the same period last year, consolidating its leadership in the proximity segment and its position as the fourth largest national operator.

In Argentina, although the decline in sales continues to be very significant (26% year-on-year at current exchange rates, down 4% LfL), comparable sales volume grew 2.7% quarter-on-quarter, also achieving a 50 basis point gain in market share compared to 4Q24.

The Company continues to strengthen the profitability of the business, with the closure of 34 loss-making stores. This strategic optimisation resulted in an expected volume loss of 1.9% in 4Q25, but with a direct positive impact on the operating margin of the business.

On a financial level, results were affected by the 57% year-on-year depreciation of the Argentine peso against the euro in Q425, which resulted in a 26.6% drop in gross sales expressed in euros, despite the operational improvement.

We believe that the sales growth confirms the Company’s strong performance in Spain, with the successful execution of the Strategic Plan and its successful value proposition, while in Argentina, despite the impact of the currency, volumes appear to be stabilising and its competitive positioning continues to improve from already excellent levels.

Dia will present its annual results on 26 February, when we expect it to confirm its strong operating performance with improved margins, which should continue to support the possibility of i) refinancing its debt, with room to significantly reduce its financial expenses and optimise somewhat dysfunctional financing, ii) recovering its dividend, and iii) taking advantage of inorganic growth opportunities that may arise in the market.

Recommendation: OVERWEIGHT, P.O. €40.5 per share.