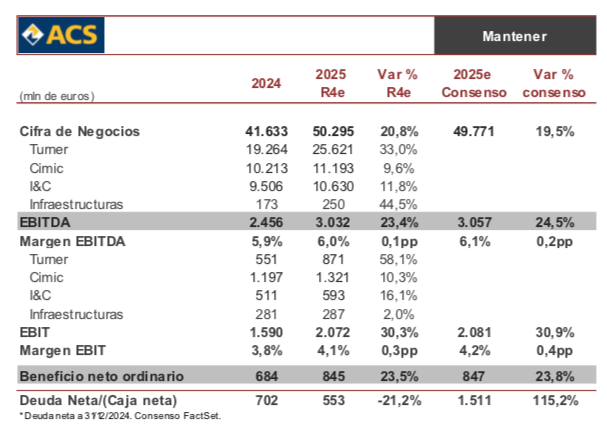

Renta 4 | ACS (ACS) is expected to publish its 2025 results on 25 February, with the time of the conference call still to be confirmed. We reiterate our Hold rating and target price of €74.60 per share.

Although we expect sales to continue to be supported by growth in segments such as data centres and different types of infrastructure, we anticipate a slight slowdown compared to 9M25 (24% versus 21%) due to the relatively lower impact of Dornan and Thiess (contributing from 2Q24), as well as the effect of currencies. We do not expect any changes in margins compared to the figures reported in 9M. Improvement versus 2024 in Turner supported by the type of projects, and in I&C by the efficiencies generated by the merger of Flatiron and Dragados; while at Cimic, the improvement in sales and EBITDA should be in the double digits due to the consolidation of Thiess, although in comparable terms we do not expect any significant changes, and infrastructure is likely to continue to be affected by the impact on Abertis of the tax regulation adopted in France. Despite the deterioration in foreign exchange rates, we expect this operating performance to enable ordinary net profit to grow to within the target range of €820-855 million.

We expect net debt to largely reflect the seasonal recovery in working capital, the cash inflow from the data centre alliance with GIP and the sale of UGL, and to improve significantly from 9M with operating cash flow expected to improve in line with results and a level of investment in line with previous periods.

At the conference, we will see what comments they can make about the expected impacts of the evolution of the dollar at the beginning of 2026. We will see if they can provide greater visibility regarding their positioning in segments such as managed lanes in the United States; defence, energy transition and data centres globally, and infrastructure in Germany. We will also see if any comments are made about the possible divestment in Clece and what opportunities could arise for the acquisition of infrastructure brownfields. We do not rule out the possibility that they may set a financial target for net profit by the end of 2026.

The share price is trading at demanding levels, so some caution is warranted in the short term, although its excellent global positioning to take advantage of macro trends is likely to continue to support positive long-term performance.