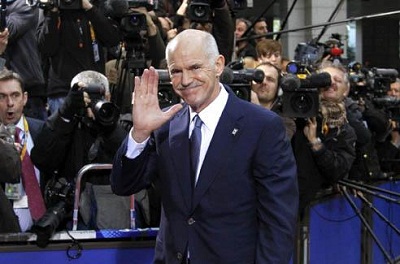

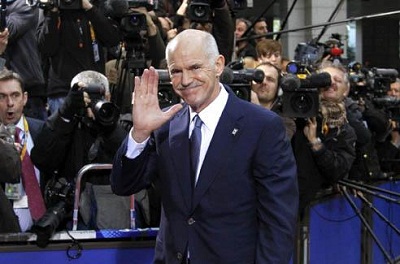

What Santander makes of the euro summit

Passing on a clarifying (!?) note from Citi analysts… “The first comments, which anticipate a much discussed and possibly without clear conclusions summit in Europe today, were disappointing. Especially on two, at the moment, important issues: banking and the EFSF. Also, the markets themselves were disappointing. Gold has again gone up sharply ($ 1,714 an ounce) as well as raw materials (crude oil $ 111.35 per barrel). This rise is…

Passing on a clarifying (!?) note from Citi analysts… “The first comments, which anticipate a much discussed and possibly without clear conclusions summit in Europe today, were disappointing. Especially on two, at the moment, important issues: banking and the EFSF. Also, the markets themselves were disappointing. Gold has again gone up sharply ($ 1,714 an ounce) as well as raw materials (crude oil $ 111.35 per barrel). This rise is…

By Luis Arroyo, in Madrid | In case you needed tangible proof of the harmful role the ECB played in the crisis, in the FT, Martin Wolf writes an open letter to Trichet’s imminent successor to the presidency of the ECB, Mario Draghi. The letter is an excellent article that convincingly explains why the ECB should stabilize the debt markets of solvent countries such as Italy and Spain, which are the…

By Luis Arroyo, in Madrid | In case you needed tangible proof of the harmful role the ECB played in the crisis, in the FT, Martin Wolf writes an open letter to Trichet’s imminent successor to the presidency of the ECB, Mario Draghi. The letter is an excellent article that convincingly explains why the ECB should stabilize the debt markets of solvent countries such as Italy and Spain, which are the…

By Miguel Navascués, in Madrid | H. Clark Johnson, professor at Yale University, identifies in a paper titled Monetary policy and the Great Recession, what he calls the six myths of U.S. monetary policy during the Great Depression. The paper not only explains the cause of the hole we’re in, but also the reasons why zero interest rate does not imply monetary expansion. In the latter case, the reason is simple:…

By Miguel Navascués, in Madrid | H. Clark Johnson, professor at Yale University, identifies in a paper titled Monetary policy and the Great Recession, what he calls the six myths of U.S. monetary policy during the Great Depression. The paper not only explains the cause of the hole we’re in, but also the reasons why zero interest rate does not imply monetary expansion. In the latter case, the reason is simple:…

At The Corner, we have a noticeable penchant for mixing news from the bright side, so we couldn’t let pass this occasion in which one of the core-Europe main actors and some British-based bank analysts have had warm opinions on the state of the Spanish economy (emphasis is ours.) According to this piece of reporting from the best-seller Spanish newspaper El País, at the end of the European Council meeting, French president…