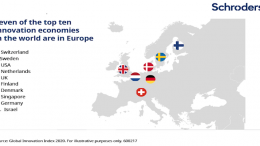

Where Can You Find Innovation In Europe?

Paul Griffin (Schroders) | Late last year, the EU agreed a €1.8 Tr stimulus package to help Europe’s economies recover from Covid-19. The funding comes from the long-term budget and the Next Generation EU initiative, whose aim is to create a greener, more digital and more resilient Europe. These goals will not be achieved without innovation. Contrary to what some investors believe, Europe is home to plenty of pioneering companies whose science and engineering capabilities can help address the many challenges facing the world today.