After Jackson Hole, Comes The Week Of The ECB

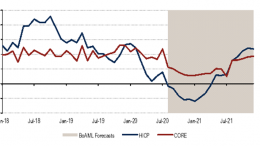

On Thursday September 10, the ECB will meet and present its updated macroeconomic table, which will give us a better idea of its expectations regarding the pace of economic recovery (the August PMIs showed signs of weakness after the strong rebound from the April lows). The central bank will also update its view on current and future inflation levels with data once again showing very contained prices and in a context where the Fed is willing to tolerate inflation above 2% to obtain this figure as an average.