Just 3 Things To Consider Before Investing In Spain

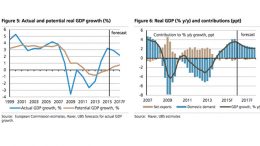

UBS | In this report, we focus on three pivotal questions that we consider crucial for investing in any security in Spain: First, what is the economic outlook for 2016/17, and what are the biggest economic policy challenges that the next government will face? Second, what are the likely scenarios for the outcome of the elections on 26 June? And third, what is the valuation and relative attractiveness of Spanish assets, how will asset markets react to different election outcomes, and what is or is not priced in?