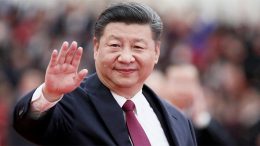

Xi Jinping Arrives In Spain With “Major Investment Projects And Trade Agreements” Under His Arm

From today until Thursday the President of China, Xi Jinping, is on an official visit to Spain. It is the first visit to Spain by a President of China for 13 years. According to the Ministry of Foreign Affairs, both countries will seek to advance the bilateral relationship in multiple areas, from bilateral political relations, geopolitics, economics and the educational-linguistic area to science, among others.