Link Securities | Acerinox (ACX) presented its results for the first nine months of the year (9M2025) on Friday, from which we highlight the following aspects:

- ACX highlighted that 9M2025 has been marked by uncertainty, and after two consecutive years of significant contraction in apparent demand, the sector remains at low levels, with a much slower recovery than initially projected.

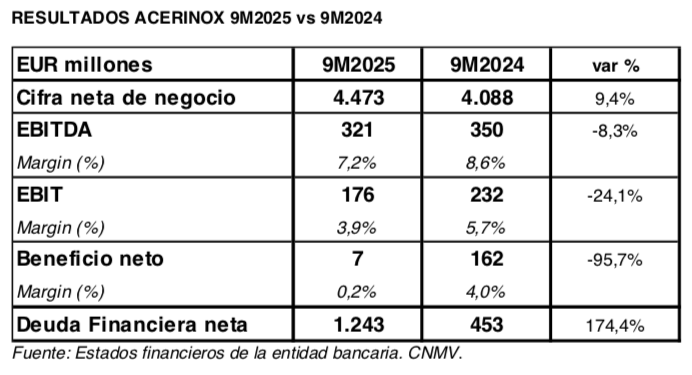

- ACX’s turnover was €4.473 billion in 9M2025, 9.4% higher than the same period last year, which was impacted by the strike at Acerinox Europe. Cumulative steel production for the year was 1,463 thousand tonnes, 8% higher than in the same period of 2024, which was affected by the strike at Acerinox Europe.

- Operating cash flow (EBITDA) amounted to €321 million, 8.3% lower than in the first nine months of the previous year. In terms of net sales, the EBITDA margin rose to 7.2% (against 8.6%; 9M2024).

- Likewise, ACX’s net operating profit (EBIT) rose to €176 million, representing a 24.1% year-on-year decline. In terms of net sales, the EBIT margin closed September at 3.9% (against 5.7%; 9M2024).

- Finally, ACX’s attributable net profit amounted to €7 million, down 95.7% compared to 9M2024.

- ACX generated cash flow after investments of €155 million, which was allocated entirely to dividend payments. The increase in net financial debt, €123 million, was due to the depreciation of the dollar.

- Outlook: Although the short term continues to be affected by the geopolitical situation and low demand in its two main markets, the US and Europe, ACX is optimistic about the medium term due to the strategy developed by the company to diversify geographically and towards products with higher added value. In this context of uncertainty, ACX must focus its attention on the continuous improvement of working capital and solid cash generation. Although demand remains weak in both markets, the situation in the US is significantly better than in Europe due to the trade defence measures established during Q2 2025, which have resulted in lower import pressure. As for the European market, prices continue to be heavily affected by excess imports. ACX welcomes the recent proposal for trade defence measures in the EU aimed at protecting the steel sector from unfair competition and global overcapacity. Once implemented, these initiatives are expected to have a positive impact on the results of ACX and the rest of the steel sector.