Bankinter | Sales recover traction in 3Q19, margins rebound and cash generation accelerates with lower investment effort and reduced inventories.

The integration of stores and online sales continues successfully and allows sustainable organic growth without eroding margins. We believe that the market will be willing to pay higher multiples for a business model that is consistently beating comparable ones that suffer from sales and margins in a highly competitive environment.

Although double-digit growth will no longer be common once the physical network and the sales area moderate its expansion, so will the investment needs of the group, which has already completed the 90% optimization of its physical network. This, together with the increase in the negative working capital inherent in the business model, sustains the group’s free cash generation and dividend growth.

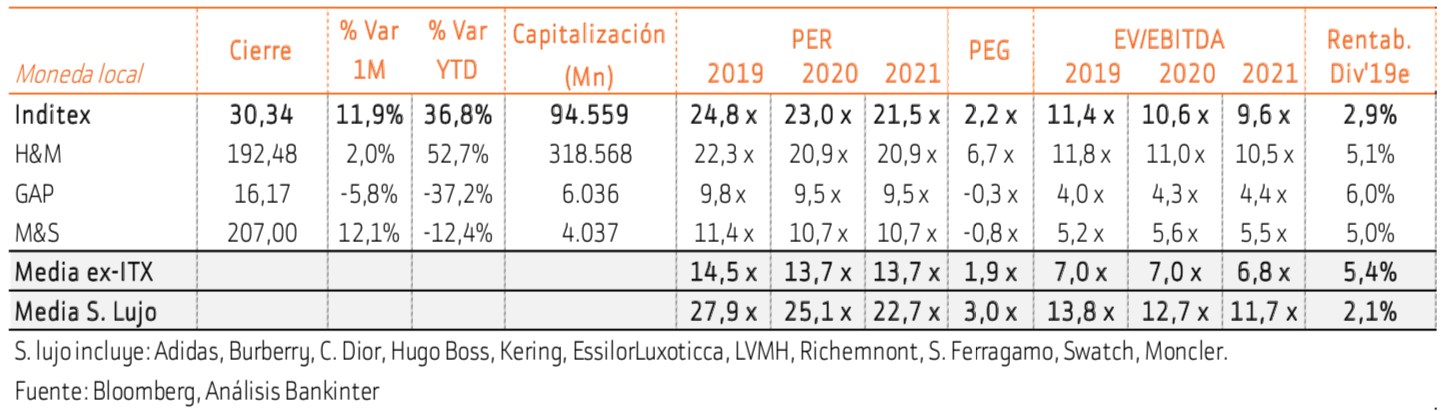

We slightly review our upward estimates to reflect more sustained margins and review our Target Price as of December 2020 up to 32 euros. This target price results in an implicit PER 20 of 24.2x vs. an average of 24.6x for the European luxury sector. We believe that the successful digital integration strategy, margin resilience and cash generation justify high multiples. We maintain the recommendation of Neutral.