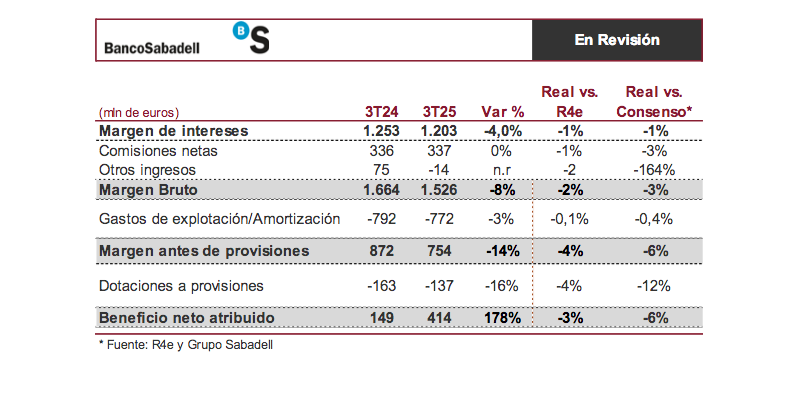

Renta 4 | Q3 2025 results were below our estimates and consensus estimates in the main lines of the income statement, with net profit 3% below Renta 4 estimates and 6% below consensus.

Highlights of the results include: 1) Net interest margin remained stable quarter-on-quarter at constant rates and fell 1% ex-TSB, with volume growth partially offsetting the deterioration in customer margin (-6 bp i.t.). 2) The cost of risk stood at 37 bp (versus 37 bp in 2Q25) with a NPL ratio of 2.75% (2.81% in 1H25 ex-TSB) and, 3) Fully loaded CET 1 stands at 13.74% (versus 13.56% in 1H25) and RoTE reaches 15% (versus 15.3% in 1H25) and 14.4% pro forma for the banking tax (versus 14.1% in 1Q25).

The gross loan portfolio continues to grow at a good pace, 3.6% year-on-year (versus 3.2% in 1H25) and, despite the seasonality of the quarter, remains stable vs 1H25. On the positive side, credit growth at Sabadell ex-TSB was 6.9% (versus 5% year-on-year in 1H25), maintaining solid rates in new consumer finance and mortgage lending, 19% year-on-year and 26% year-on-year in 9M25, respectively. This evolution of the loan portfolio will support net interest income in the future.

They reiterate the objectives of the 2025-27 Strategic Plan presented in July, which, we recall, will focus on profitable growth while maintaining the focus on risk profile and better price segmentation in consumer credit.

They expect to achieve a net profit of >€1.6 billion in 2027 (versus €1.39 billion in 9M25 and €1.644 billion in 2027 Renta 4 estimate) and a RoTE of 16% (versus 15% in 9M25 and 15.1% in 2027 Renta 4 estimate), with a mid-single digit CAGR 2024-27e in net fees and commissions and a healthy loan portfolio (versus 2% and 1.4% Renta 4 estimate), and a net interest margin of €3.9 billion (vs €3.822 billion Renta 4 estimate).

We expect a negative reaction in the share price as estimates have not been met, despite reiterating the guidance for the year ex-TSB: net interest income of €3.6 billion (versus €2.709 billion 9M25), mid-single-digit growth in net fees and commissions (versus 3.7% year-on-year 9M25), low single-digit growth in operating costs (0.5% year-on-year 9M25) and cost of risk close to 40 bp (versus 37 bp 9M25). Recommendation and target price Under review (previously Hold T.P. €3.29/share).