BARCLAYS | Although Q3 numbers were in line with expectations we remain cautious on the outlook, particularly in Brazil but with the other major geographies of Spain and the UK also facing earnings headwinds. In addition, limited capital generation in the quarter reaffirms our view that Santander’s weak capital position is a hindrance to a re -rating of the shares. With our earnings and capital forecasts unchanged, we retain an Equal Weight rating with a €5.00 price target.

Capital bottom of the pack

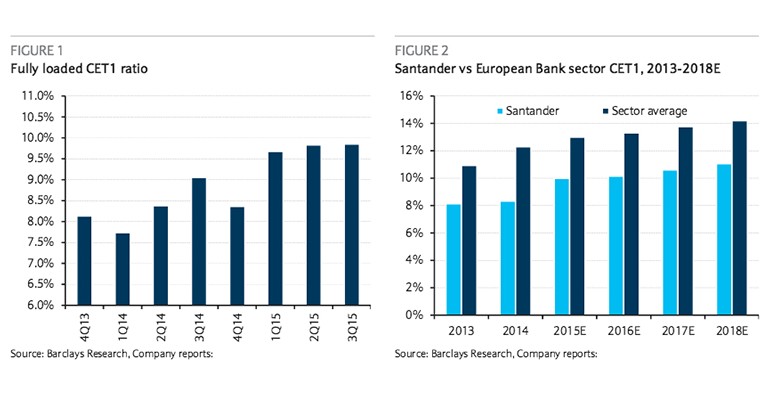

Santander delivered only 2bp capital accretion in the quarter with the CET1 ratio rising to 9.85%. We expect it to reach 10% in 4Q15, rising through 11% by 2018. While this is encouragin g, we estimate that this will still leave Santander as one of the more thinly capi talised European banks with a CET1 ratio consistently 2-3% below the sector average.

A slow weakening in Brazil so far

Q3 saw some slowing in revenue momentum and another weakening in credit quality but nothing too alarming. However, we see the economic downturn as posing significant risks to pre provision earnings momentum and credit quality with plenty of scope for earnings to deteriorate significantly in the coming quarters.

UK revenue challenges

Earnings momentum in the UK has stalled with the net interest margin declining as expected and a slight dete rioration in fees. These trends look set to continue until UK policy rates begin to rise an d while credit quality is likely to remain very good, there seems little scope for it to boost earnings.

Mixed outlook for Spain

Although management see the pace of net interest margin erosion slowing, we continue to expect so me further deterioration through 2016. With loan growth hard to come by we believe that it will be difficult to meaningfully grow revenue in Spain. However, credit quality cl early continues to improve, which should lead to further significant falls in provisions.