The consortium formed by ACS (with 24%), SNC Lavalin, Aecon, Pomerleau and EBC, has been chosen to design and build an automatic train (an underground train without a driver) for the metropolitan area in Montreal, Canada. The contract includes 67 kms of rail line and 25 stations. The total investment in the project is €3.3 billion and it is expected to provide service to 45 million passengers a year in 2031. It’s the largest transport infrastructure project which Quebec has undertaken since the inauguration of the Montreal metro in 1966.

The project will be the fourth most extensive automatic passenger transport system in the world after the ones in Singapore (82 kms), Dubai (80 kms) and Vancouver (68 kms).

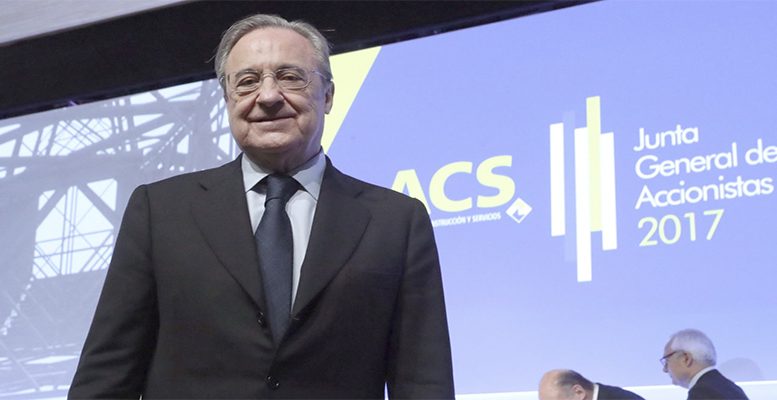

ACS’ participation in the project represents 1.2% of the group’s total portfolio, and although it doesn’t have a huge relative weighting, Renta 4’s analysts believe that ACS’ “consolidation in the North American market is positive since it is its main market in terms of sales.” In fact, this market contributed 44% of the company’s revenues in the first nine months of 2017. And at end-January, it won the contract to build the airport train in Los Angeles.

For Bankinter analysts, the news will not have any relevant impact on the share price, which will continue to perform relatively worse than the Ibex 35.

“This is due to the possibility that if Atlantia improves its offer for Abertis this will oblige ACS and Hochtief to raise their initial 18,76/share offer if they want to go ahead with the acquisition of the Spanish concessionary.”