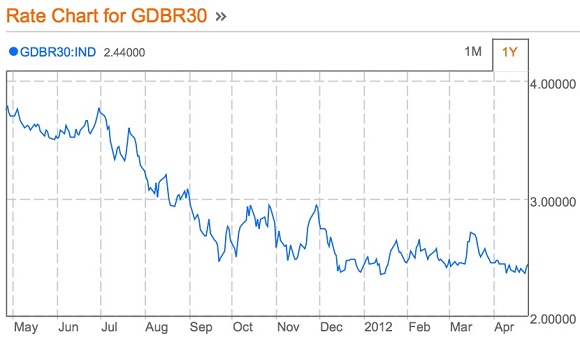

MADRID | The German Treasury placed Wednesday €2.4 billion in 30-year bunds with an average return of 2.41%, down from 2.62% in the previous auction. The bid to cover dropped to 1.1 times from 2.1 times.

Berlin admitted that demand had been lower than expected, and the total sale volume planned had been left uncovered. In a note to investors, Citigroup in Spain commented on the German explanations and made an interested, interesting comparison:

“This reflects a context of volatility and uncertainty, but more importantly, the German Treasury believes that the market is saturated and the ability to absorb more paper is limited.

It says nothing of the interest rate payable, an interest rate as low as to discourage demand. However, today we could see strong demand for the $35 billion in 10-year paper offered by the US.”

The German government set its growth forecast for the next two years at 0.7% and 1.6%. The upward development would account for a strong consumption levels, with disposable income rising by 3.3% and 3.1% respectively for both years. On the inflation risk, considers that there is a problem although the evolution itself is not worrying.

Profitability in 10-year bunds is now at 1.73%, below the US’s by 27 basic points (the 10-year US bond is at 1.98%).

Be the first to comment on "Look at US T-bill sales before blaming market saturation for lower bund demand"