“We expect the overall fiscal and monetary policy mix to stay accommodative, although the pace of broad-based monetary easing is likely to slow. We expect fiscal policy to be more expansionary, with increasing local government spending to support investment, particularly in infrastructure.”

“The possible announcement of a third CNY1trn local government debt swap plan, with close to CNY1trn completed so far, should help to support local government spending. We believe the continued downside risks to growth and the expected large pipeline of local government debt issuance justify further monetary easing. Therefore, in addition to the recent interest rate cut and targeted RRR reduction, we continue to look for one benchmark rate cut of 25bp in Q3 and one to two RRR cuts of 50bp each in H2 15, depending on liquidity conditions.”

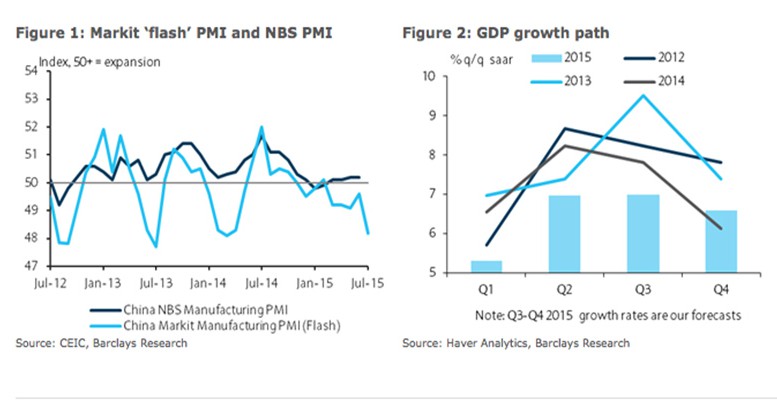

Be the first to comment on "China flash PMI falls to a 15 month low"