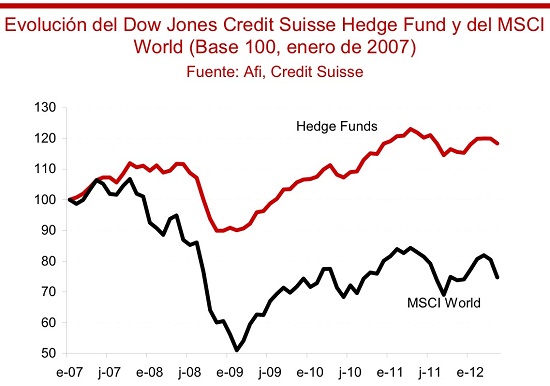

Hedge funds are better at fighting back amid terrible economic conditions and financial weather. Just look at the graphic.

According to the FT Lexicon, they are investment funds that aim to meet high targeted returns using aggressive trading strategies that involve the movement of large amounts of capital from one market, asset class or currency to another. According to most European politicians, though, they are the greediest of the market participants, acting mainly as short-sellers behind the demise of companies and countries that don't deserve their attacks.

But they take an awful pile of risk when they bet that a stock price will go down, and they seem to be on the right track if you take their results as proof.

make money at homeight=”386″ />

The positive correlation between equity markets and hedge funds, at 85 percent, was the cause why their profitability rate fall to -1.3 percent in May as the MSCI World Index dropped by -7.1 percent (the MSCI World Index is a free-float weighted equity index that includes developed world markets and excludes emerging markets).

These data come from an Afi report, in which analysts noted that

“hedge funds, though, are capable of minimising losses in negative environments and reach gains in periods of 6 to 12 months, and have achieved a revaluation of 2.6 percent in 2012.”

Not everybody is happy within the hedge fund sector, to be sure. While distressed and multi strategy hedge funds post so far in the year a positive 4.5 percent, in the dedicated short bias category there's a loss of -7.6 percent, and of -2.3 percent in equity market neutral.