A&G | The Q1 results season was solid on both sides of the Atlantic. And up to now EPS for 2022 has been revised 3% upwards by S&P500 and 11% by the STOXX 600.

The weighting of the raw material sectors, particularly in Europe, helped to drive EPS estimates (ex EPS estimates for raw materials they rose only 2% YTD in Europe).

We are beginnning to see signs of a slowdown in profits, although for the time being these are concentrated in areas oriented towards the consumer, as well as some technology companies.

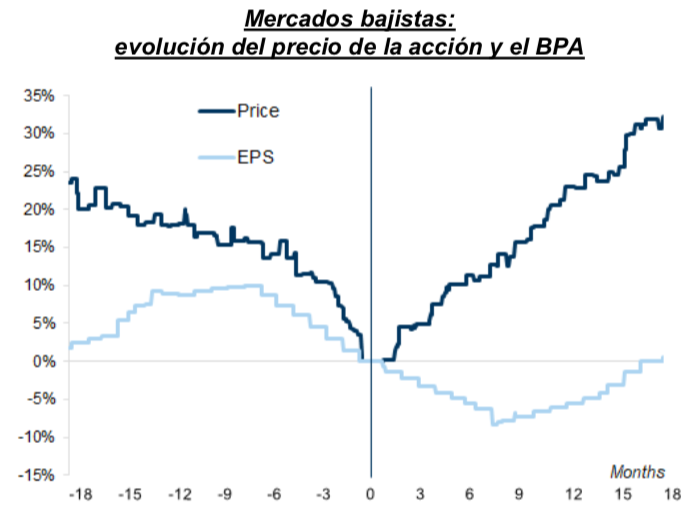

Historically, the market falls between 6 and 9 months before the EPS touches its minimum point. This means that profits continue to decline even when the market begins to recover, reaching the phase of “hope”.

Profits are still falling, prices are rising quickly and valuation is the main force behind the returns.

Bear Markets: Evolution of the share price and EPS