UBS | The current global growth scare, which has recently focused on the US, has set off a train of events that, rather implausibly, is leading to modest outperformance by EM (v. DM) equities in down markets so far this year. We explain this very simply; worries over the US economy have pulled the dollar lower and have, for now, taken some, much – needed, currency pressure off EM equity markets.

It’s a Dollar Trade

In the five years to end – 2015, EM equities fell by 31% and EM EPS fell by 29% (both in dollars), while the dollar TWI index itself rose by 33%. Therefore, little absolute value opened up in EM on earnings – driven metrics, although EM did build up a large discount to DM (up 30%, with EPS up only 2%) over this period. While the trigger, in our view, for global investors to increase positions in EM (v. DM) has to be evidence of an earnings recovery in EM, any dollar sell-off helps in this process.

Oil Prices and EM Equities go Together

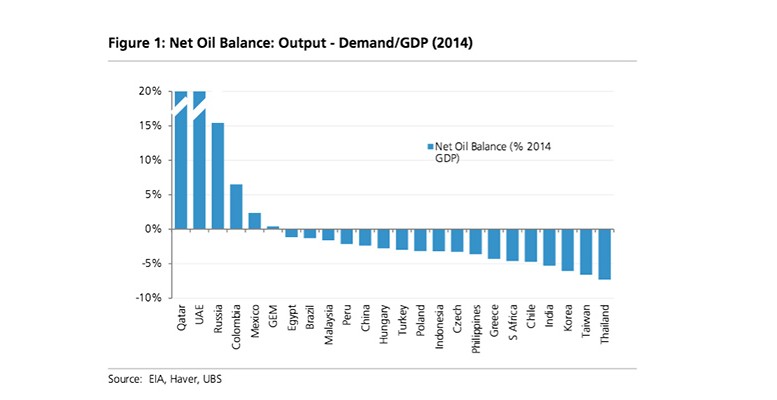

While only four EM index countries were net oil exporters in 2015, there is a close long – term correlation (>0.8) between oil prices and MSCI GEMs (0.9 since the end of 2014). We explain this by arguing that most recent major oil price moves have been largely demand – driven (with the obvious exception of 2014 H2). Rising oil prices tend to mean rising overall global demand, rising EM demand and strong EM equity markets; these effects then overwhelm any negative impact of higher oil prices on EM consumers and energy – intensive companies. One clear piece of good news for EM short – term would be a sustained bounce in oil prices (which likely also means a l ower USD).

Can This Continue?

Weak US growth, global growth worries and a falling USD lead to EM outperformance, as long as commodity prices don’t collapse. Is it really that simple? How far can this go? The UBS view supports this argument in the narrow se nse that we expect the EUR/USD to fall to 1.16 by end – 2016. The danger is clear; there may well be a tipping – point eventually where outright US (and global) recession restores the dollar’s safe haven status and there is a flight to quality out of EM assets again. The recipe for EM to outperform, therefore, would seem to be a ‘cooler’ Goldilocks in the US (weak growth, but not too weak with no/little Fed), but not an outright recession.