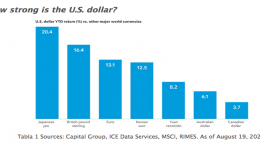

More and more countries (EU included) seek to mitigate risk of dollar dependency

Morgan Stanley | Crypto analyst Sheena Shah reviews the digital currency initiatives that central banks (CBDCs) are starting to put forward as an alternative to the use of cryptos. The use of cryptocurrencies for everyday payments is complex and expensive for the consumer and the ecosystem has not developed, except for in Switzerland. Companies such as Adyen have no plans to incorporate crypto payments into their offerings Their conclusions are…