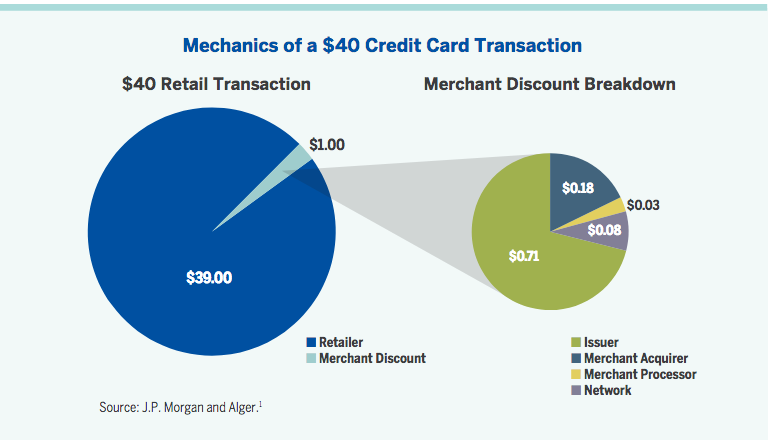

Alger (La Française AM) | With the rise of digital payments, the economics of credit and debit transactions has been a hot topic as investors try to figure out the best places to invest in the payment ecosystem. So where does your digital dollar go?

When a retailer sells an item for $40 via a credit card transaction, it typically pays out $1 or 2.5%, which is known as the merchant discount. That 2.5% goes to a number of companies, creating a tightknit network of counterparts in the digital payment experience.

The financial success of these players is levered to the growth of digital payments, which are increasing significantly faster than the broader economy. The two largest drivers of this growth, e-commerce, i.e., buying goods or services via the internet, and mobile payments, i.e., smart-phones used to process transactions using wireless communication or scanning QR barcodes, are increasing at a mid-teens percentage.

In addition to these parts of the digital payments ecosystem, we believe that other players stand to reap substantial benefits from growing digital payments such as platform and wallet providers like PayPal and chip providers like NXP Semiconductor. We believe digital payments is a robust corner of the market that may hold many potential opportunities for investors.