UBS comments are as follows:

The Russian economy is certainly slowing which may be aggravated by recent sanctions and their economic fallout. Nevertheless, we are far more concerned with potential impacts in Ukraine, where the sharp GDP contraction (the IMF has recently revised downwards its GDP expectation to -6.5% from -5%, UBSe -6.4%) could be magnified by foreign currency lending – over 40% of total loans and over 75% of mortgages – in a context where the Hryvnia has devalued some 30% against the Euro/USD ytd.

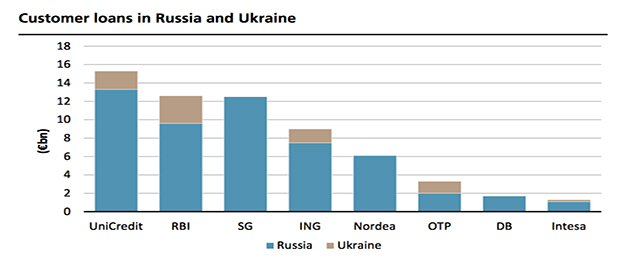

OTP and RBI the most exposed in relative terms, but quality matters here too

Relative to RWAs, OTP and RBI present the largest lending exposure to both Russia and Ukraine – loans to those countries represent some 15% of RWAs for both. However, simple rankings can be misleading here. First, we are far more concerned about the exposure to Ukraine, and the potential losses there, than to Russia. Second, we think that the business mix and quality of the local operations still make some difference. RBI and UniCredit, for instance, appear to own good quality banks in Russia. While we see OTP’s operations in the consumer finance segment as potentially more vulnerable.

Valuation: Risks partly priced in but watch out for the AQR implications

Most stocks with meaningful exposure to Russia and Ukraine have underperformed either the broader sector or their immediate peers. We think that the upcoming AQR will force banks to early recognition of potential losses in problematic parts of CEE, where we include Ukraine. Among the stocks in focus in this note, we rate Buy Intesa (PT €2.75), ING (PT €12.4), SG (PT €50.4) and Nordea (PT SKR 103.0) while all others are Neutral rated.

Be the first to comment on "European banks: How concerned should they be of Russia-Ukraine conflict?"