The banking union process is proceeding, althout it doesn’t appear to be quick or easy. And I am not talking about creating a common deposit fund. Nor about the need to implement the single resolution mechanism for crises. There is something much more obvious: the lack of banking consolidation. There are a lot of banks, some with high levels of internationalisation. But few, almost none, which are clearly pan-European. Here are some figures recently published by the ECB.

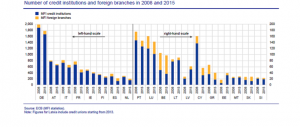

1. The number of European credit institutions (EU) declined slightly last September compared to June, from 3,261 to 3,172.

2. Assets fell 2.8% in the previous period to 33.97 trillion euros. If we now look at the whole of the banks (including subsidiaries and bank branches), there were 5,475 at end-2015, down from 5,614 in 2014. And from 6,767 in 2008. At the end of the day, there has been a clear consolidation process amongst the banks at a national level over the last 10 years. Although in too many cases this has been the result of pressure to cut costs, as well as restructuring and balance sheet adjustments.

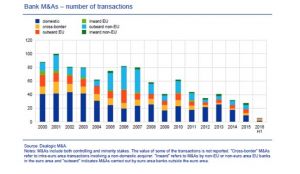

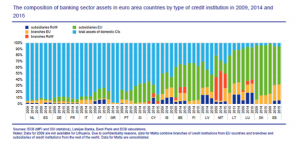

That said, and always according to ECB figures, M&A transactions both inside and outside the Eurozone (but with a buyer from within the region) have slowed down in the last few years. And how do they divide up between domestic banks and the rest…

Total assets….

And how they are divided up between domestic banks and the rest…

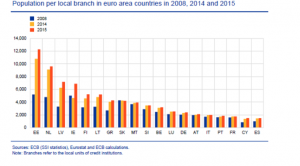

Two more graphics, population per local bank and per bank employee…

Two more graphics, population per local bank and per bank employee…

The volume of M&A in the European banking sector has gone from 39 billion euros in 2008 to scarcely 9.5 billion in 2015. And in the first half of last year, it was little over 1 billion euros. And why has there not been more consolidation in the sector? It’s an important question. And I believe it’s the European authorities who need to answer it.