By Luis Arroyo, in Madrid | Very briefly: for those who have let themselves fall for the euphoria that unfolded after the European Central Bank governor Mario Draghi reported on unlimited short-term sovereign bond purchases, I would like to remind them of what happened during the last weeks of 2011 and the beginning of 2012.

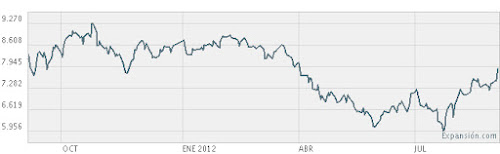

Back then, the ECB introduced its long-term refinancing operations, which were meant to inject liquidity into the European banking system of the euro area. Its immediate effect was that premium costs of credit from the markets dropped for troubled peripheral States like Spain. Unfortunately, yields on Spanish 10-year bonds increased thereafter, as the first chart shows. On the second chart, the behaviour of the stock market index Ibex 35. The ECB miserably failed. So be careful, be cautious.

Be the first to comment on "I-told-you-so graphs for ECB worshippers"