M&G Valores | A sustained annual growth in profits of 4% is well below that of previous bull cycles in the stock market, but seems realistic in the current situation. We have on one hand the modest growth of developed economies (secular stagnation), and on the other the composition of the Ibex dominated by regulated sectors, with modest growth, and the banks.

Banks are a cyclical sector which in theory should enjoy much higher growth, but in Europe’s current circumstances the market forecasts only modest growth.

In short, we find ourselves with an index with moderate profit expectations in comparison with previous cycles and which, in large part will generate returns through dividends rather than increase in share value.

In concrete, starting from a return on dividends of 4.5%, and a long term increase in profits and own dividends of 3% per year, the expected long term returns on the Ibex would be 7.2%, of which 4.8% would come from dividends and only an average of 2.4% from share value increase (the dividends are discounted from the index).

I believe that a long term annual return of 7% from the Stock Market is a reasonable forecast in the current environment of weak growth and low inflation, but it could be frustrating for stock market investors accustomed to more intense cycles.

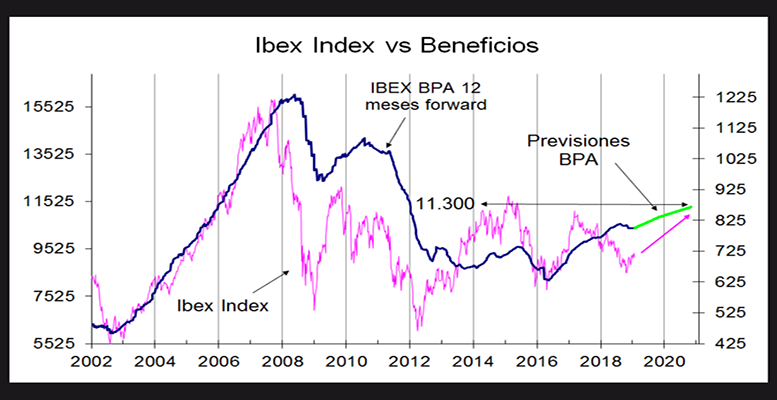

At the moment the Ibex is somewhat undervalued which would allow expectation of a significant recovery towards around 11,300 by the end of the year.