Morgan Stanley | We run over the main themes which are affecting the banking sector at the moment. In terms of balance sheets, the sector has on average 420 bp of excess capital, lending support to dividends.

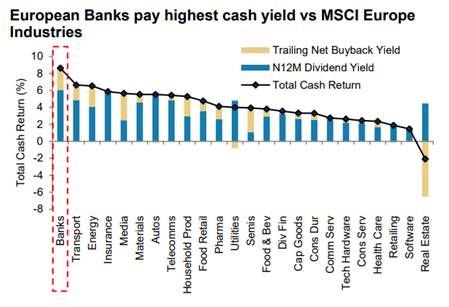

The sector in Europe has greater cash yield (div + buybacks). Exposure to Russia has been decreasing proactively, on average 12% down vs figures pre-Q1 2022.

Net interest income has the support of the hikes in interest rates, which is a game changer (analysts point to 50 bp of increases in the Eurozona vs the marcro which assumes 125 bp).

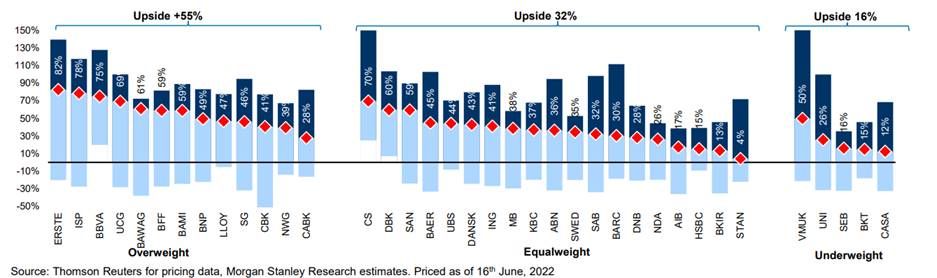

Therefore, the risk in estimating profits is rising. The current valuation assumes a cut in EPS similar to that of the pandemic. And although the sector is beginning to discount the rises in rates, the valuation discount (40% vs market) is still high due to the concern over credit.

Top picks: Caixabank (CABK), Intesa, Lloyds, Commerzbank, BNP.