UBS | After Outlook conferences in 8 countries, we highlight that 2017 is expected be the first time in 7 years that global nominal GDP growth accelerates.

Where do we get pushback on Outlook 2017?

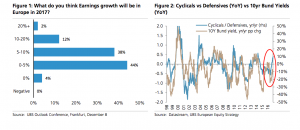

Earnings growth is the key for European Equities in 2017. We forecast 8%: the bottom up consensus is 13.5%, but this has been downgraded for 6 years in a row and on average by 12 percentage points. We see earnings momentum and critically revenue momentum as stabilising and massive base effects at work (half of the consensus growth rate comes from Commodities and Financials). But given the many false dawns there is some (understandable) scepticism from investors. Interestingly, at our Outlook conference in Frankfurt only 14% of investors thought that earnings growth would be 10% and above (Figure 1).

Cyclical Rotation: How much longer can it continue?

Cyclicals have outperformed Defensives by 27% since the low in bond yields on July 8. This is the 2 nd best run in a decade and not far behind the 34% move in 2009 after the Financial Crisis. The move has even got ahead of the sharp rise in bond yields (Figure 2). Valuations have normalised somewhat – the DY relative and P/BV relative are now both close to long run averages. We stick with a slight tilt to cyclicals in our sector strategy, but would refrain from chasing all cyclicals here.

What did we learn from our colleagues?

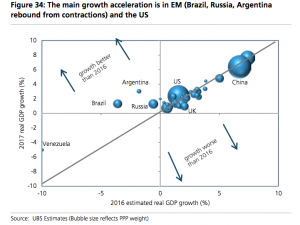

Our economics team expect 2017 to be the first time in 7 years that global nominal GDP growth accelerates.

We highlight below our Economics team’s graphic that illustrates the delta for real GDP going into 2017. The size of the bubble refers to the size of the economy and those above the line are growing more quickly in 2017 than 2016. Roughly half of the pickup in Global growth is coming from the US where we see growth normalising to the post -crisis period (from 1.5% in 2016 to 2.4% in 2017). The other half of the pick -up comes from some of the larger EM economies, such as Brazil and Russia.

In the Eurozone, our Economics team do not expect a sharp acceleration in fiscal stimulus, but they see it as an upside risk to their central scenario for GDP growth if it were to occur. We would highlight that for companies exposed even to a small amount of fiscal stimulus, if spent in the right direction, could be important. We are more cautious on the outlook for the UK than the rest of Europe and work from our UK economist, John Wraith, shows how real earnings growth may well turn negative next year as inflation picks up (Figure 37). In turn, this points to a potential slowdown in the domestic economy and is linked to retail sales. Whilst 75% of FTSE 100 revenues come from overseas we still expect a drag from domestically exposed stocks.

What’s the potential impact of US fiscal easing?

Our Global macro strategy team have looked at the potential impact of significant fiscal easing in the US, post Trump’s election victory. Their conclusion is that the key question is whether there are powerful fiscal multipliers or not. Below we show their analysis of the impact on the US 10yr, USD and S&P 500 of each assumed impact of each $1trn additional fiscal easing spread over 10 years.

Oil – just how big have the capex cuts been?

Our head of European Oil research, Jon Rigby, has highlighted the large cuts in upstream capex. UBS estimates that its global coverage universe of 79 major oil companies will cut upstream capex by 46% over 2014- 16. This is equivalent to ~$220bn in annual upstream investment forgone. This figure would be closer to $530bn if we were to gross up for partner participat ion, roughly the GDP of Belgium. The cut in capex has set up a dynamic that will likely mean lower supply in the future, meaning c. 4mbd lower conventional production capacity by 2020.

Banks – Reflation trade?

Our banks team highlight that the US banks have tracked closely with the move up in inflation expectations, but the Europeans have been slightly less correlated in the last leg higher.