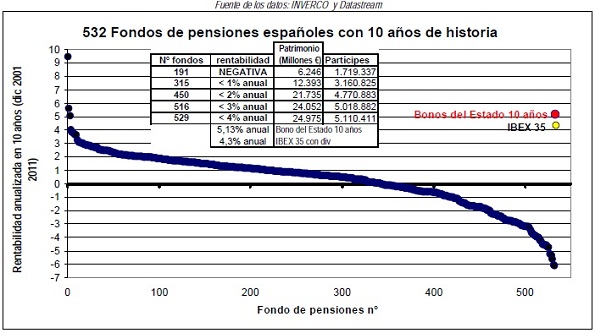

MADRID | Pablo Fernández, Javier Aguirreamalloa, Luis Corres Avendaño | In the period between December 2001 and December 2011, returns on the IBEX 35 were at 4.3% while government 10-year bonds’ were at 5.13%. Among the 532 pension funds with 10-year history, only two funds exceeded the return on 10-year sovereign bonds and only three funds exceeded the 4% return.

Even worse, 191 funds had negative average return (in December 2011 these funds had 1.7 million participants and assets of €6.246 billion). A reasonable enough question, then: is the favourable fiscal discrimination funds still enjoy of any use?

* Access here the complete report.

Be the first to comment on "Monday’s graphic: 10-year Spain’s bond vs 532 pension funds"