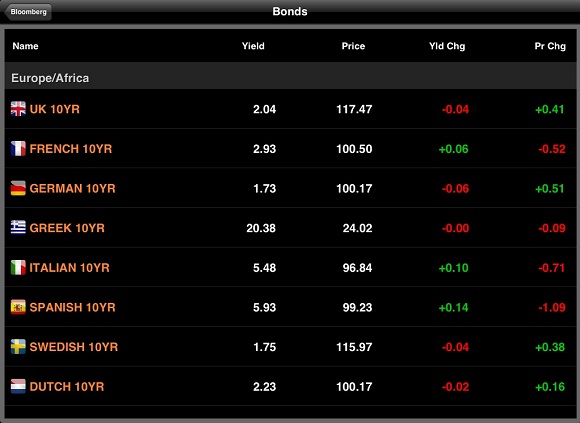

Too true. Undeniably, this was the frightening scene on Friday, which heated the discussion about what’s next for the Kingdom of Spain, with even some Greek bouzouki music on the background.

But. Analysts at Sabadell Bolsa reminded the markets of a few facts, probably compelled by the amount of fog gathered during the last days over the state of the Spanish finances and its economic prospects. Although acknowledging that domestic imbalances are a direct threat to the country’s stand before the investing community and that any recovery will only come about after a long and hard effort, Sabadell experts said the pessimistic discourse was unfounded.

“The increase in risk premium spread and yields could make it impossible for the Spanish State to attract sufficient investment and, consequently, would cause the nation to have to be bailed out. In April, Spain faces €24 billion in maturities.

“Yet, the Spanish Treasury has already sold €98 billion, which represent 53pc of all planned issuance for 2012. In addition, April will be the month in which VAT is collected. Spain could wait until after summer to issue debt again.

“Debt per GDP ratio in Spain is one of the lowest in Europe, 68.5% in 2012, and the Treasury could endure high yields for months without further worsening of its public balance sheet.”

“hasta el verano”…..uh, si es que llega!