Spanish banks benefited from both the general improvement of recurrent revenues and the containment of expenses and provisions. But credit lending is growing too slowly and so are their profitability levels.

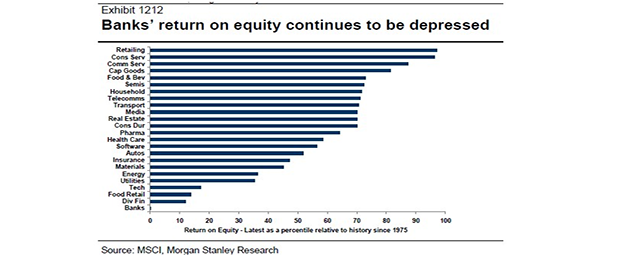

ROE improved last year, but it is still standing around 6% -it used to be around 12% before the crisis.

Moreover the Spanish banking sector is, along with the French, the most profitable in Europe (in Germany the average ROE is of 1.3%; 2.2% in the UK and Italy -11.5%).

Aside from profitability, Spanish banks managed in 2014 to achieve a significant improvement in recurring revenues for two main reasons: better margins thanks to less deposit costs and more commissions obtained from investment and pension funds.

Experts at Afi also point out that financial operations (ROF) still have a significant weight in the lenders’ results. In fact, if you exclude this item, several entities would have presented losses last year.

Another key for the numbers’ improvement has been the reduction of financing costs and lower provisions. Also the increase in the volume of business and the lending incipient reactivation – although the total volume of credit lending decreased by 2.4%.

All listed entities have notably increased their solvency ratios: from Santander’s 9.7% core capital (including a €7.5bn capital increase) to the 12.3% in case of Caixabank.

Be the first to comment on "Spanish banks: better numbers but return on equity still weak"