“Good news for the Spanish economy, which is finally reducing its dependence on foreign financing,” BBolsa in Madrid said Thursday in an investor note. During the third quarter of 2012, net borrowing/lending was equivalent to 1.3 percent of the national GDP, which was a first since 1998.

The reason for this positive move is twofold: economic agents have prioritised the reduction of their debt burden, and businesses’ savings have increased by 6.1 percent–the highest jump since 2008–or €22.7 billion.

In other news, analysts also highlighted that the Spanish index Ibex has this week benefited from higher capital flows into risk assets, lower volatility and hopeful news about the banking industry and telecommunications.

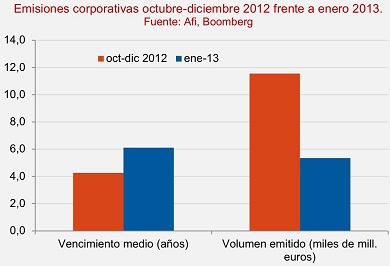

Some large Spanish companies–BBVA, Telefonica, Popular, CaixaBank, Gas Natural and Abengoa, among others–have taken advantage of this week’s context to tap the markets for at least €5.3 billion in bonds and notes, with 2, 6 and 13-year maturities. In comparison, this figure is almost half the €11.55 billion reached between October and December last year.

Be the first to comment on "Spanish economy’s net financing reaches 14-year high"