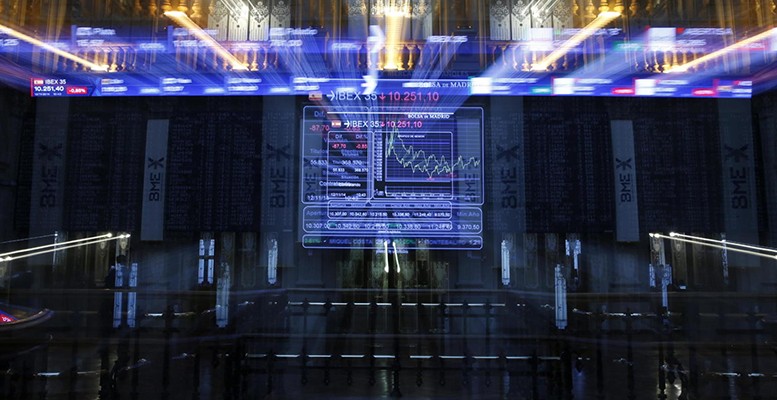

Until the tense situation in the country is resolved, the Spanish stock market will continue to suffer more than its European peers. As an example of this, in the week up until October 4, Spanish equity funds lost $229 million, according to market data firm EPFR.

Those in charge of the big fund management companies are confident that in the end there will be a negotiated outcome and not independence. They are mindful of the fact that Spanish legislation does not permit a break up.

For that same reason, they don’t believe what’s going on in Spain can have any impact on the rest of Europe, where stock markets have actually risen this week despite the situation.

In fact, flows towards European equity funds exceeded $1 billion for the third consecutive week, driven by the region’s economic recovery, EPFR said.

Credit Suisse International’s wealth management investment director, Michael O’Sullivan, told Reuters he was not expecting to change his investment strategy due to events in Spain. “It’s very easy to get bogged down in these issues, but we look at their impact on the market and on the macroeconomy,” he said.

Apart from international fund managers, those who are being affected by the situation in Catalonia are the investment funds which have positions in the big Catalan companies. In the case of CaixaBank, the Spanish funds with the biggest exposure at end-June were the lender’s own CaixaBank Gestion Bolsa España fund, with over 30 million euros invested; then Santander Acciones Españolas, with almost 16 million euros; and ING Direct Fondo Naranja Ibex 35 with 15 million euros.

In the case of Banco Sabadell, the fund with the most weighting in that bank was also Santander Acciones Españolas, with nearly 90 million euros in June (over 8% of its portfolio), followed by BBVA Bolsa and the ING Direct’s Spanish equity fund.