By Luis Arroyo, in Madrid | It's been a good match, and the Spanish government has played quite well. From the very beginning, the minister of Economy Luis de Guindos dispelled any fears about a Greek bailout for Spain. Here's what I say: those wanting a seizing over the Spanish cabinet are welcome to join the club of the frustrated fans of coups d'état. Indeed, Spain's government faced a difficult game but the outcome is a gesture of support from the European Commission to them and to our economy, too.

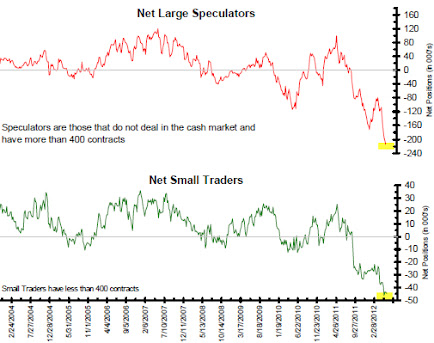

But let's open the scope. The markets are a different field. The truth is that the situation of the euro requires decisive moves. Sober Look brings these two graphs. The first one shows the level of positions against the common currency, from large and small speculators.

ex gf goexback.com how to get your ex backenter;”>

The second chart features the Swiss national bank's foreign currency volumes regarding the euro. As you know, the Swiss central bank follows a policy of ensuring an exchange of 1.2 Swiss francs per 1 euro. In order to keep this rate, the bank buys all euros offered in the market against Swiss francs, which turns into an expansive monetary policy as circulation of Swiss francs increases.

The conclusion is obvious in both cases: this is what people make of the euro, which is to say it is not only Spain's banks that people lost their confidence about.