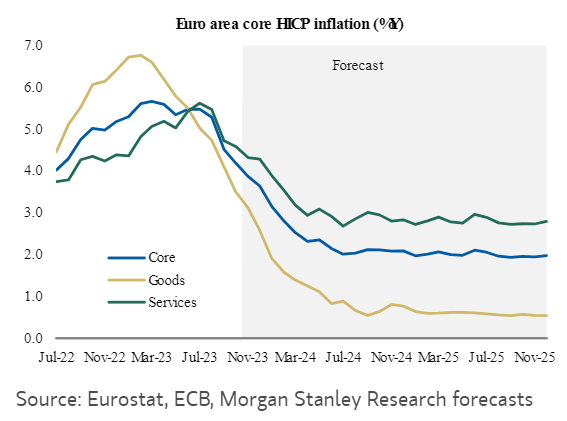

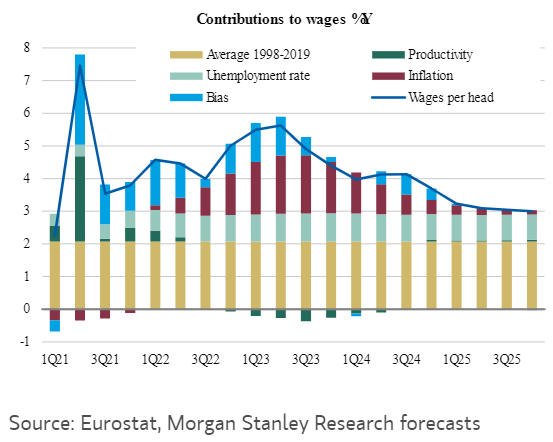

Morgan Stanley: Eurozone inflation is clearly on a downward trajectory. After October’s 2.9%Y in October, we expect inflation to be 2.4%Y in 2024 and 2.0%Y in 2025 and although the main risk is the pass-through of wage growth to prices we believe that profit margins provide a sufficient cushion to keep prices from rising as much as wages.

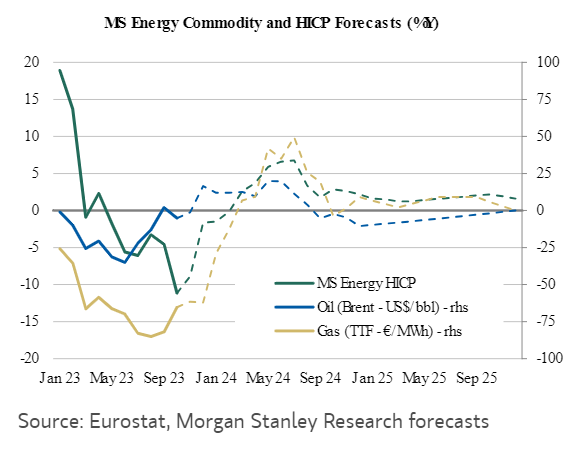

However, inflation will continue to be exposed to gas price increases as last winter showed that the price reaction to supply-demand imbalances is immediate.

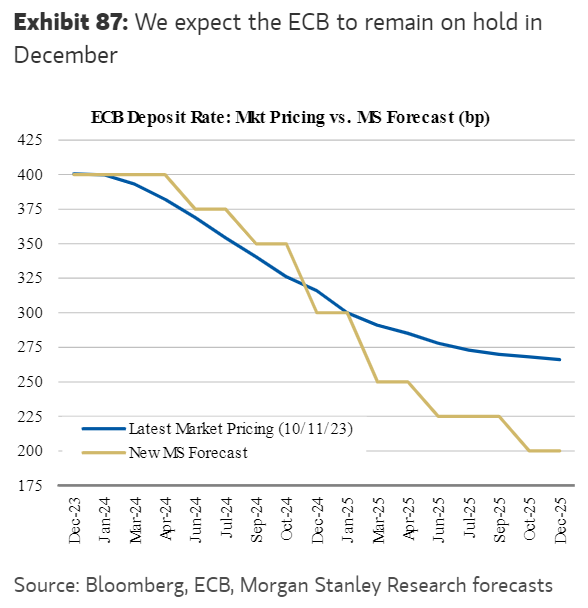

Given this macroeconomic outlook, we reiterate that the ECB will not raise rates further but we also believe that they will wait to see a deceleration in wages before starting to cut rates… thus justifying the first 25bps cut in June 2024… to 2.0% in September 2025. In terms of the balance sheet, we believe the ECB will give guidance on PEPP reinvestment in January… and start tapering from April onwards.