Luis Arroyo, in Madrid | It’s the talk of the town. The euro zone desperately needs to become a fiscal union and, voilà, everything will be sorted. But I wonder: how do we get there?

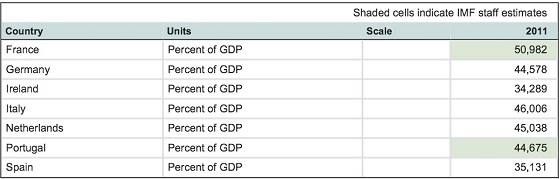

Have a look at the chart below, which reflects fiscal pressure levels in core Europe economies and in some of the peripherals’. What do we see? We clearly spot the huge differences among them (which are even higher when you check the figures by sector). Ireland seems to charge capital very lightly while Spain is nowadays increasing the tax weight with all the new austerity plans. There is a 15-point gap between France and Spain, and 10 points of distance between Spain and Germany.

A fiscal union will not come easily. Spain, for instance, is not a highly productive country, although it’s output has definitely improved. To increase fiscal pressures, even if it is temporarily as the Rajoy government assures us, is suicidal. Spain’s productive structure isn’t as strong as France’s, and offer price is paramount to its exports sectors.

This cannot be fixed in a couple of years. Changes must be done in terms of quantity but of quality, too. See Portugal; how could its industry improve competitiveness under such gigantic fiscal repression?

In Spain, if the fiscal charge isn’t higher is no due to the government’s wise observation but because its scope to further collect taxes is really low. But a fiscal union would push us in that direction. Germany wouldn’t like to unify fiscal spending without unifying fiscal income.

That’s why Germany rejects the idea of a euro debt union. I mean, why would Germany willingly pay higher interest rates on its credit?

Be the first to comment on "European fiscal union? Eurobonds? Good luck convincing Germany"