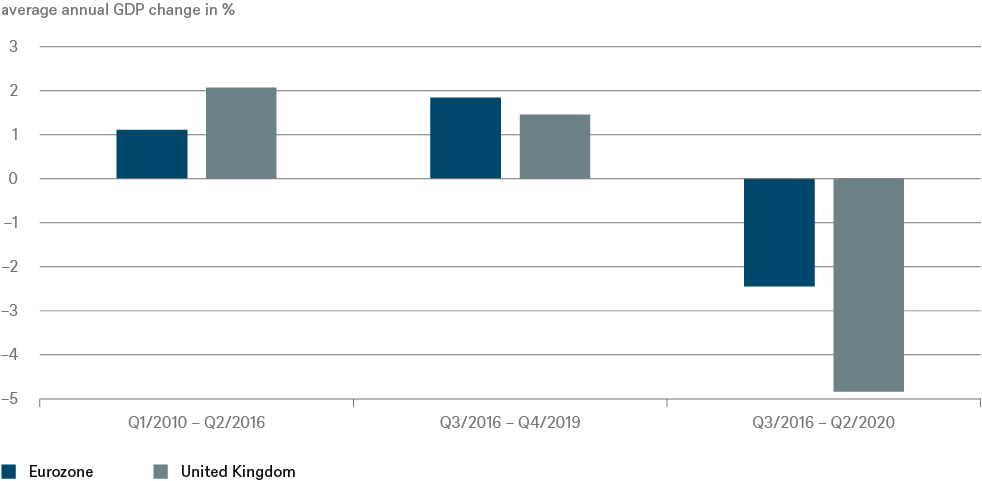

The UK will probably be spared the horror scenarios of an abrupt end to cross-border traffic or a sudden shortage of pharmaceuticals or specific foods. Nevertheless, London in particular should be keen to avoid any additional damage caused by leaving the EU. As our “Chart of the Week” shows, the outcome of the EU referendum has already inflicted considerable economic pain. While the United Kingdom recorded significantly higher growth rates (and thus gains in prosperity) than the rest of Europe in the years prior to the EU referendum, it is lagging since then. As Katrin Loehken, UK economist at DWS, observes, that underperformance started well before the Covid-19 crisis, which triggered an even more severe economic slump in Britain than on the continent. Including the development in 2020, even Italy has now overtaken the British economy in terms of growth.

Of course, this has not gone unnoticed in financial markets. The European stock market, as measured by the Euro Stoxx 50, has outperformed the British market (FTSE 100) by more than 20% since June 24, 2016 – which is substantial even when discounting for different sector weightings. Chip in the devaluation of the British pound, and the difference increases to more than 30%. So in our view there are enough reasons not to play va-banque[1] in the upcoming negotiations, especially from the British perspective.