Following a strong start to the New Year, 10y Spanish and Italian spreads versus Germany have performed very well again over the past quarter, especially after the ECB’s comprehensive easing package in June, tightening a further 25-30bp, to about 135bp and 145bp, respectively. Our recommendation for the past two years (mainly since the OMT program announcement in summer 2012) has been to hold a strategic long position in core peripheral spreads initially in up to 5y area, which we shifted to 10y part of the curve in December 2013.

Given the levels reached in these spreads, we recommend shifting from a strategic overweight view to a tactical stance.

Fair value framework for Italy and Spain: How low is too low?

ECB spread modelling has to be approached with caution due not just to the nature of the eurozone debt crisis and the complicated dynamics involved in it, but also to the fact that there is a reasonable amount of ECB backstop/easing effect reflected in them. We believe it should be used as just one element of the investment decision, instead of being the single basis for it.

Undoubtedly, the announcement of OMT was an inflection point in the eurozone debt crisis, kick-starting the reversal process of euro convertibility risk in the euro area.

Improvements in the institutional set-up of the euro area – namely, banking union progress and the commitment to follow this up with economic and fiscal union eventually – has further facilitated this process. Finally, the structural reform effort in almost all of the peripheral countries has helped diminish the growth and fiscal gap between them and Germany, also playing a very important role in the continuation of the notable peripheral spread tightening over the past two years. The only significant economic/fiscal indicator that still has not reversed and remains unfavourable for Italy and Spain is their debt levels (as a percentage of GDP) versus Germany.

ECB premium is largely priced in spreads

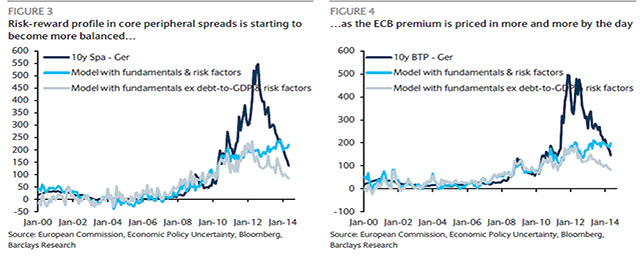

Our model framework, which takes into account economic/fiscal fundamentals and risk aversion factors, indicates a fair value level of about 200bp for 10y Italy and Spain vs Germany, which we see as an upper bound.Partly to reflect a more optimistic scenario that takes into account the ECB backstop and further potential interventions (such as QE etc), we remove debt-to-GDP from our set ofmodel factors to establish a lower bound. The high debt problem for most peripheral countries is something that will take many years to reverse and the ECB’s commitment through OMT and potential QE can contain these concerns to a large extent, as long as it maintains its credibility. Under this more optimistic scenario, fair value moves down to 90-100bp, which we see as a lower bound.

New further ECB stimulus is also not around the corner anymore

after the announcement of a comprehensive easing package this month, the ECB’s aim for this year will likely be to ensure the recently announced measures are well digested, rather than rushing into a new complex program, such as QE, unless absolutely necessary. As such, all else equal, we think the probability of EGB-based QE this year has fallen. While we do not see this as a factor that would de-stabilise EGB markets, we think it might lead to peripheral spreads losing their aggressive tightening momentum.

Use market-friendly cash flow dynamics during the summer to take some profits gradually

The bottom line is that we think core peripheral spreads are currently in the process of establishing a bottom after 350-400bp of tightening over the past two years. In valuation terms, we think 10y core periphery spreads are 30-40bp away from stretched levels and the risk/reward in holding onto the long core periphery spread position on a strategic basis is more balanced. Therefore, we are shifting to a more cautious tactical stance, rather than a strategic long view.

In the near term, we keep our long in 10y Italy and Spain vs Germany spreads, given that the supply/cash flow outlook should remain benign over the summer months. Spain and Italy will have completed c.69% and 64% of their gross issuance requirements for 2014 by the end of June. As a result, their monthly issuance run rates will be much lower in the remaining part of the year, especially in the summer months, relative to the first half.

July and August will also have notable redemptions and coupon flows in Spain and Italy (total redemption and coupon flows in these months are €24bn and €52bn, respectively), which should help make the cash flow dynamics market friendly in the near term. Overall, we would see any further summer tightening in Italian and Spanish spreads as an opportunity to take some profits ahead of the September pipeline.

Be the first to comment on "The fair value for Italian and Spanish spreads"