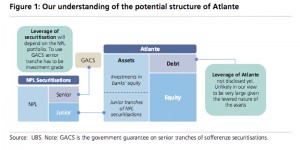

UBS | Il Messaggero published yesterday a draft memo with some details of Atlante, the system -wide fund that has been created to secure banks’ recapitalisations and purchase NPLs. Though not the final version, the fund’s size is seen at €3.0 -6.0bn, it should not trigger state-aid and investors will have until 28th April to commit. Intesa San Paolo/Unicredit are likely to deduct from CET1 their share of banks’ equity owned by the fund based on the threshold mechanism. Main unknowns relate to the leverage potential of the fund and the NPL transfer prices.

Not a comprehensive solution, but potential to be the right tool for a targeted problem

Atlante was never meant in our view to be a solution for Italy’s sector-wide asset quality concerns, which are of a structural nature and hence will take time to heal (see our note ). However it has the potential to address the sector’s most pressing problems, including recapitalisat ions and high level of NPLs in more troubled institutions, which we believe should mitigate the rapid increase of systemic worries seen in recent weeks. Also, the set-up of Atlante shows us that there is no desire to have Intesa San Paolo/Unicredit bear the vast majority of the costs of systemic operations. In the case of Intesa San Paolo, despite moderate solvency impact deriving from the (likely) deduction of banks’ equity, this should go some way to reassuring on the safety of the capital return story. As for Unicredit, this implies no immed iate capital headwind and should allay fears about the bank’s solvency needs.

The main question: is this enough?

Negative stock price reaction after the draft release suggests investors’ disappointment about the lack of additional details and probably an overall sense of this being an ad – hoc, rather than a comprehensive tool to address the country’s credit quality issue. Maybe our expectations were more modest, but we feel a moderate degree of leverage can provide the fund with enough firepower to guarantee weaker banks’ solvency adequacy and “derisk” entities with abnormally high NPL levels, contributing to the reduction of overall systemic risk levels. We expect to gain clarity as April progresses, but believe enforcement of the NPL transfer process is ess ential to win investors’ favour over time. For now, we would expect both Intesa San Paolo/Unicredit to regain some of the ground lost in the last two weeks, with our relative preference still concentrated on Intesa.

*Image: Flickr /Giancarlo Gallo