LONDON | How much money did the UK government borrow in April? Less than you might have assumed. In fact, the public sector borrowing report for the last month brought strong surpluses: net figures excluding financial interventions gave a surplus of £16.5 billion compared to a deficit of £9.1 billion in April last year, and the total net volume saw a surplus of £18.8 billion from a deficit of £6.2 billion in the same period 2011. The public sector net cash requirements surplus was significantly strong, with £23.2 billion versus a £6.2 billion surplus in the same month last year.

They must be happy at Whitehall. A note from Barclays Capital, though, tells us the secret of that extraordinarily improved behaviour of the State administration’s money management:

“The better performance of the public finance data compared with this time last year was mainly as a result of the transfer of assets worth £28 billion from the Royal Mail Pension Plan to government accounts.”

The accounting change has had a direct effect on net borrowing, lowering it by the total value of the asset transfer. Without this effect, net borrowing excluding financial interventions would have reported a deficit of around £12 billion, implying a worse outturn than City expectations.

Nevertheless, Barclays analysts remark,

“the revenue stream continued to be steady despite the weakness in the economy… Current receipts were £0.5 billion higher than in April 2011. This was a result of higher VAT receipts, and higher revenues from national insurance contributions, income tax and capital gains tax.”

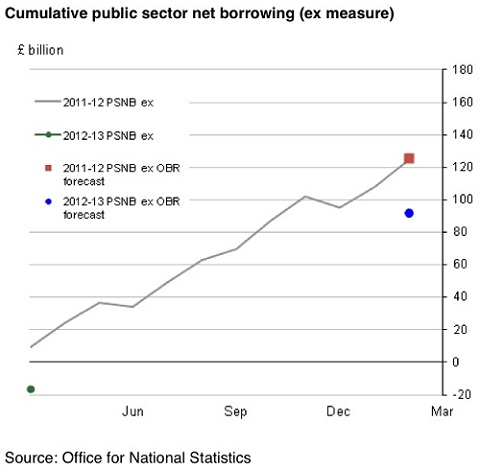

What matters, anyway, is whether deficit cut targets are met, and not only this is so because the Coalition has promised to but because investors feel so anxious under the euro stress that they could some day begin losing confidence in UK sovereign bonds, too.

Well, April being the first month of the fiscal year tells us little about the government’s progress in reigning in the national debt. This Royal Mail pension plan thing, on the other hand, sends a different message.

“The government would not allow a private sector company to get away with such shoddy accounting practices,” professor of insurance and risk management Philip Booth says.

“When the government faces the electorate in three years, it will claim that the national debt has been reduced by this £28 billion. In fact, the national debt has been increased as a result of this transaction.”

From now on, the Royal Mail pension plan is a liability on the public finances, not a deterrent for the companies that will be interested in an acquisition in the future. Yet, if the government successfully privatises the Royal Mail at some point, that is with a nice profit, this move may still prove a clever one.

Be the first to comment on "Where did the UK public deficit in April go? Ask the Royal Mail"