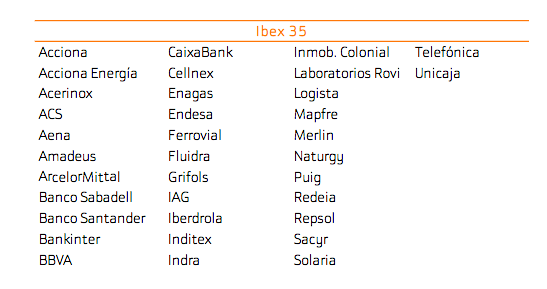

Bankinter | Next Thursday 12 December the Technical Advisory Committee (CAT) will hold a meeting to review the composition of the Ibex 35. On this occasion we do not expect any changes.

What do we think will happen at the CAT meeting?

The CAT will keep the composition of the Ibex 35 unchanged. The traded volumes of the aspirants are lower than those of the current constituents and therefore do not justify any changes. The best positioned candidates on this occasion are Vidrala and Meliá, but their trading is clearly lower than that of ArcelorMittal or Logista, which are the components with the lowest volumes. Moreover, Meliá does not meet the minimum capitalisation requirement. In conclusion, we do not expect any changes at the meeting on the 12th.

What are the CAT’s decision-making criteria?

- First, the CAT computes the trading volume in euros in the order market during the control period, the six months prior to the meeting. In addition, it considers different factors to ensure the quality of this volume. Among others, it analyses aspects such as the number of contracted trades or possible changes in shareholding.

- Secondly, only those securities whose average capitalisation is greater than 0.30% of the average capitalisation of the selective index during the aforementioned control period can form part of the Ibex 35. In any case, the technical rules consider the free float of the different securities and, to this end, establish different coefficients to be applied to their average capitalisation, so that those whose free float is lower are penalised.