Intermoney | Acciona (Buy, PO €200) and Acciona Energía (Buy, PO €29) have published their 3-month trading statements (TS), in which they do not provide P&L data, only operational data. The companies will not hold conference calls.

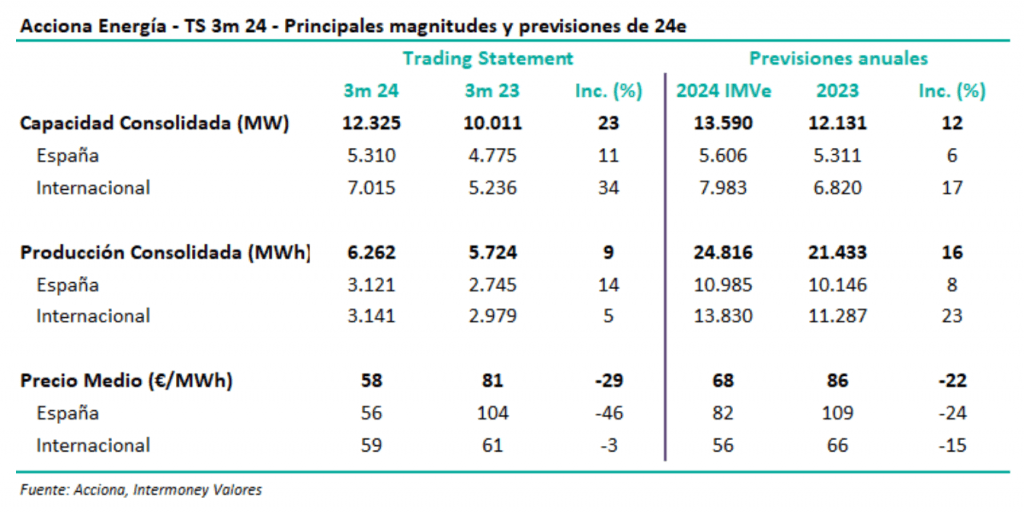

Acciona Energy’s key operating data is shown in the attached table, along with our forecasts for 2024e as a whole. Overall, ANE expects to reach its capacity increase target of 1,700 MW in 2024, but acknowledges that the outlook is currently NOT to be able to generate EBITDA of €1,100Mn, guided last February, due to low price levels in Spain. ANA does expect to be able to invest the announced €2,500Mn in 2024, ending the year with a debt/EBITDA ratio of 3.5x.

Acciona expects to announce an asset rotation in the coming months, which will be Spanish wind.

Last March we already lowered our EBITDA estimates for ANE by almost -20%, in view of the accelerated price falls, remaining in line with guidance, so there is room to cut our figures again. However, the Group also reports that it expects some recovery in pool prices in Spain in the coming quarters.

Within Energy (ANE), the highlights of the SC are as follows:

Capacity: Increase of about 200 MW in Australia and the US; confirms target of 1,700 MW increase by 2024; keeps about 1,800 MW under construction currently.

- Productions: Growth of +9%, including +14% in Spain due to the consolidation of Renomar; +5% increase in international, against a capacity growth of +34% year-on-year, with this increase probably still in testing. ANE recognises, overall, a lower than expected production.

- Prices: Decrease of -46% in Spain, due to the collapse of the pool in Spain (€45/MWh); hedges, at an average of €80, mean that the price achieved was €56, compared to our forecast of €82 for the year as a whole, which seems quite optimistic. ANE sees a strong recovery in pool futures to around €60. International prices in line with expectations.

In the rest of ANA’s activities:

- Infrastructure: ANA reports a continuation of growth in line with that seen in recent years (more than +20%), thanks to Australia and LatAm. Backlog increased by +1% in Q1 to €25bn.

- Nordex: Globally consolidated since April 2023, orders in Q1 up +100% to 2,086 MW; margins 3.3% versus -9% last year (our forecast is +3.0% for 2024e); margin guidance between 2 and 4% for this year.

- Bestinver: AuM up +9% to €6.445bn on improved fund performance.