Earnings per share increased by 31% year-on-year, supported by strong profitability (RoTE of 13.6%). TNAV plus cash dividend per share increased by 11% while capital remains above 12%

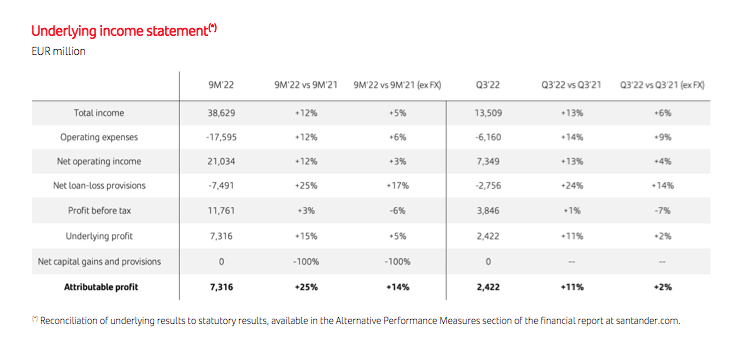

In the third quarter alone, attributable profit was €2,422, up 11% year-on-year (+2% in constant euros).

The group has seen strong growth in customer activity in the first nine months of 2022, with loans and deposits growing by 7% and 6% respectively in constant euros (i.e. excluding currency movements), and total revenue increasing by 5% on the same basis.

Inflationary effects led to an overall increase in costs (+6% in constant euros), however, in real terms, costs fell by 5%. The cost to income ratio was 45.5%.

Loan-loss provisions increased by 17% in constant euros, due in part to the release of provisions in the second quarter of 2021, as well as a further normalization in provisions in the US.

All regions (Europe, North America, South America) and Digital Consumer Bank delivering strong returns and growth in customers, loans and deposits.

Ana Botín, Banco Santander executive chair, said: “The group delivered another strong quarter, with revenues increasing and profitability remaining above target at 13.6% RoTE, supported by our rock-solid balance sheet (. ..) We expect the macroeconomic environment to remain challenging as markets across Europe and North America adapt to levels of inflation not experienced in decades. Our team has proven experience in navigating these conditions successfully and we are confident revenue growth will offset cost inflation pressures and any increase in cost of risk. We are confident that our consistent track record in increasing profitability, reaching a year-on-year EPS growth of 31%, will drive further increases in our TNAV and dividend per share, creating value for shareholders.”

The board remains committed to its 2022 shareholder remuneration policy to distribute approximately 40% of underlying profit, split approximately in equal parts in cash dividends and share buybacks.