By CaixaBank research team, in Barcelona | Tensions in Europe’s sovereign debt markets have grown again, especially in the so-called peripheral economies. Increasing rumours regarding Greek’s possible exit from the euro area have played a significant part. In Spain, this escalation has been sharpened by further capital requirements for banks and the increasingly widespread doubts as to whether the fiscal deficit targets will be met, particularly after the upward revision of the final deficit for 2011 by 4 tenths of a percentage point to 8.9% of gross domestic product (GDP). The data available for the first quarter have not provided any arguments to oppose this view. It is therefore necessary for the fiscal consolidation policies adopted by the government to start to bear fruit.

In fact, the yield on Spain’s 10-year bonds reached 6.3%, exceeding its German equivalent, the bund, by more than 500 basis points. This differential, a mesure of the risk premium, is a new record since the start of the financial turmoil. During the last month, the increase in yield was actually generalised among all Spain’s debt securities, irrespective of their maturities. As a consequence, the interest rates demanded for new debt issuances carried out by the Treasury have increased significantly.

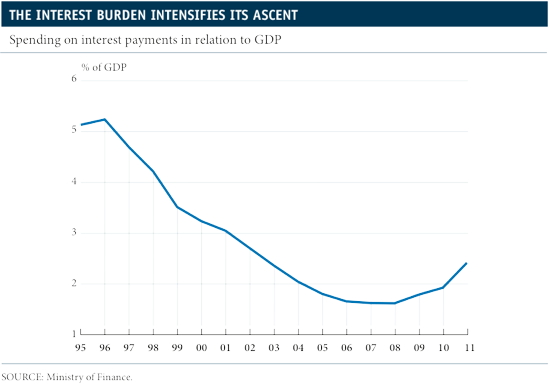

This higher cost of financing, together with the progressive increase in public debt, will continue to swell the interest burden, defined as the interest paid by the public sector in relation to the country’s GDP. As can be seen in the graph above, interest payments reached their lowest level in 2008, when they represented just 1.6% of GDP. Since then, this ratio has risen noticeably, reaching 2.4% in 2011. The government’s forecasts state that this trend will continue and the interest burden will go above 3% of GDP in the coming years. This level is similar to that of the euro area as a whole and significantly lower than the level recorded in the mid-1990s.

However, the increased spending on interest payments is an additional obstacle to meeting the ambitious public deficit targets contained in the 2012-2015 Stability Programme. According to this, the public imbalance will be 5.3% of GDP in 2012, a target that has not altered in spite of the recent increase of 4 tenths of a percentage point in the final deficit for 2011, to 8.9% of GDP, due to the revision of the figures for the autonomous communities.

For the moment, the efforts being made to adjust the government deficit are having a very limited impact. The hike in direct taxes and cuts in investment, intermediate consumption and wages have helped these items to decrease by €1.8 billion during the first quarter of 2012. Yet, this adjustment was totally wiped out by the decline in the cyclical component of the budget flows, specifically higher interest payments and lower revenue from indirect taxes, especially value added tax. If, moreover, we include advances of current transfers to the autonomous communities and Social Security, the cumulative government deficit for this period reached 1.2% of the GDP expected for 2012. This figure is 4 tenths of a percentage point higher than the one recorded for the first quarter of 2011.

Be the first to comment on "Spain’s interest payments on public debt are lower than in the 1990s"