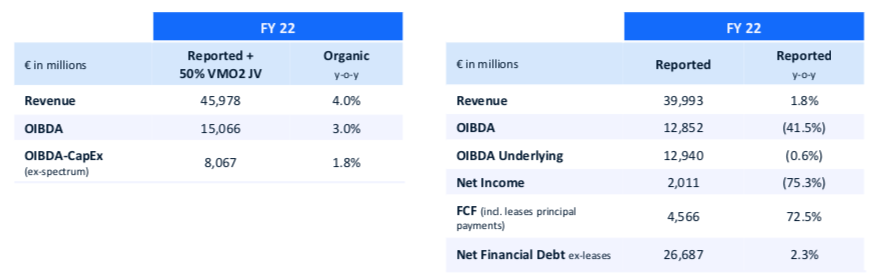

Main figures compared to Bloomberg consensus: Revenues €39,993M +1.8% in reported terms, +4% organic) vs. €39,686M estimated (+1.0%); Recurrent OIBDA €12,852M (-0.6% reported, +3.0% organic) vs. €12,747M estimated (+0.6%); OIBDA Margin 32.1% vs. 32.1% estimated, BNA €2,011M vs. €1,967M€ estimated. Free Cash Flow €4,566m vs. expected €3,786m. Net Financial Debt €26,687M vs. €27,020M expected (vs. €28,918M in 3Q 2022 and €26,000M at December 2021).

Targets for 2023 are “low single digit growth” in revenues and OIBDA and CAPEX (ex-spectrum) on sales of 14%. Maintains 2023 dividend at €0.30/share.

Opinion of Bankinter’s analysis team:

Results slightly beat expectations. In organic terms, Revenues (+3.9%) and OIBDA (+3.5%) maintained positive growth for the seventh consecutive quarter, and accelerated vs Q3 (+3.8% and +3.1% respectively).

By countries, revenues and OIBDA in organic terms: Spain +0.2% and +0.2% respectively; Germany +6.6% and +6.6%; Brazil +31.0% and +10.1%; VMO2 -1.7% and +0.4%.

The results meet the group’s targets for 2022: “high single-digit growth” in revenues and “mid-to-high single-digit growth” in OIBDA. Spain remains the group’s most competitive market, but for the first time it has managed to stabilise OIBDA (previous quarters -4.9% in Q1, -3.4% in Q2 and -2.8% in Q3). The tariff hikes offset the increase in personnel costs (+7.8% rise in salaries) and in content. This was offset by greater strength in the rest of the group’s key markets. In the UK, synergies at Virgin Media O2 accelerated, in Brazil the incorporation of Oi’s mobile customers and assets continued and in the rest of the markets the competitive environment remained stable. OIBDA margin declined -100bp in the year to 32.1%.

Net Debt reflects the tax refund of €1,300m; in the year it grew +2.6%, leaving leverage at 2.54x OIBDA (vs 2.6x at December 2021). Despite a high dividend yield (7.8%), organic free cash flow generation is moderating in an environment of higher cost of debt and economic slowdown, which hinders the triple objective of debt reduction, investment in innovation and sources of future growth and shareholder remuneration. We maintain our recommendation at Neutral and our Target Price at €4.2.