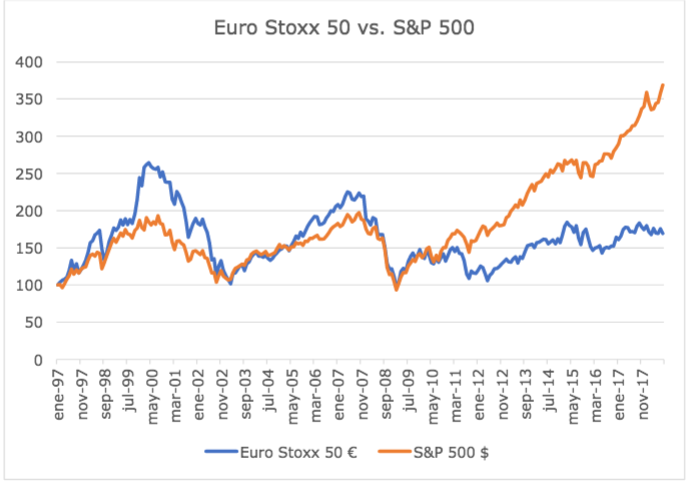

In recent years, one of the most repeated commentaries when recommending investing in European stock markets tends to be: Why should invest in European stockmarkets when the American stock markets outperform them year after year? The easiest, most immediate, is that which comes from recording the stock prices, in points, in both indexes, the Euro Stoxx in the Eurozone and the S&P 500 in the US. Taking 100 as the base in both cases, their listings from January 1997 until now (22 years of history which coincide with the birth of the Euro Stoxx 50 index), in broad brush, for the first fourteen years the two markets moved almost in parallel (apart from the clearly superior European performance in the period 1999-2002). Only since 2011, and until now, can a clearly superior and sustained performance by the S&P 500 be observed.

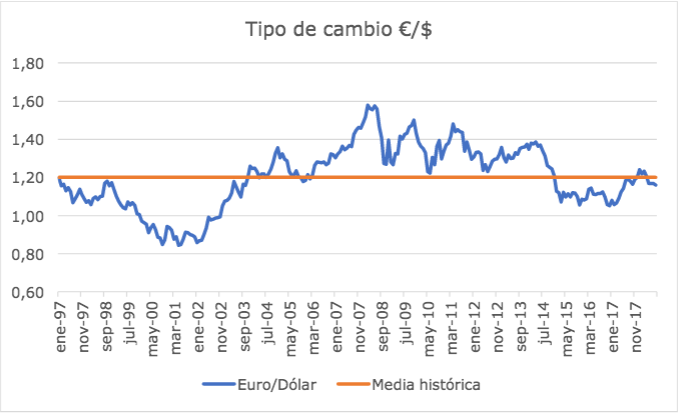

Comparing both indexes, in points, however, does not give us a correct view of what has been the profitability for the investor. A European who buys US and European stocks compares their profitability in a single currency (the Euro). The American makes the same judgement in dollars. And the currency oscilations in recent decades has been signficant. From 1997 to 2002 the Euro depreciated significantly against the dollar. Between 2005 and 2011 it appreciated significantly.

European and American stock markets would have offered almost identical returns, with almost mirror performances, between 1997 and 2003. However, between 2003 and 2007, the better returns on the Euro Stoxx 50 would have been significant. With the 2008 crisis and until 2011 the returns became more equal again only to diverge clearly in favour of the American market from 2011. What has happened from 2011 until now to cause the American stock market to so outperform its European counterpart?

If we had to synthesize, the comparison between the evolution of the most typical sectors of each of the stock markets, those which had most weight in the indexes Euro Stoxx 50 (banks) and the S&P 500 (technology), it would make things clearer. A strong fall in the European banking sector because of the 2008 crisis, from which it has still barely recovered, compared to a strong appreciation in the technology sector (represented in the Nasdaq 100 index) in the American market. In the Euro Stoxx 50, the company SAP is one of the few exceptions with weight in the technology sector. At the end of the nineties, and in the first decade of the new millenium, there was a sector, that of telecommunications operators, which performed in the European market in an identical way to the Nasdaq.

Entering in the current decade, the perfomance of both indexes has begun to diverge, to be radically different compared to previous years. The European telecommunications operators have languished in the markets, beginning to be listed as mature public service companies who depend on their dividends and losing all the value that the expectations of internet business generation (Terra, T-Online …) built in 15 or 20 years ago.

The four principal European telecommunications operators (Deutsche Telekom, Orange, Telefónica, Telecom Italia), which at one point had a joint capital of almost 800 billion Euros, have lost a fifth of this stock market value. They have paid significant dividends during recent years, but in any case, the return to the shareholder has been clearly negative. Nokia, one of the leading companies by capitalisation in the Euro Stoxx50 in 2000, whose stock value exceded 400 billion Euros (forcing the imposition of a mazimum value of 10% in the weight of any single stock in the Euro Stoxx 50 index, which it would have exceded by the strict stock market capitalisation criterion), has seen its capitalisation divided by 10.

The value lost by Nokia has been absorbed by the new unquestioned leader in smartphones, Apple, which twenty years ago was a small computer company which scarcely exceded 10 billion dollars in stock market value (and which today multiplies by a hundred that figure. And the stock market capitalisation lost by the European telecommunications has been gained by the two American giants in that business at a global level, Google and Amazon, who twenty years had practically not been born.

Apple, Google and Amazon, together with the traditional software leader, Microsoft, form the quartet which has led the major rise in the Nasdaq. In other words, the excellent performance of the Nasdaq 100 could be deconstructed in the following way: Nasdaq 4, which has multiplied value by 11 (27% compounded annual growth) and Nasdaq 96 which had multiplied value by 2.7 (commendable, but not a stratospheric 10% compunded annual growth). In fact, without the contribution of the four major companies, the Nasdaq would currently still be slightly below the maximums reaches in 2000.

Approximately a quarter of the difference in returns between the European and American markets result from what has just been explained. But the remaining three quarters of the difference in returns, and what has really marked the different evolution of both indexes, result from the banking sector.

From the end of the previous century until barely seven or eight years ago, European and American banks performed in a similar way in the stock market. They rose significantly between 2002 and 2007, fell dramatically duting the financial crisis of 2008, recovered slightly in the the two years immediately after the crisis, and, only after 2011, began different stock market paths. While the stock market value of American banks have multiplied by 4 in the last seven years, that of the Europeans has barely multiplied by 1.3.

The most obvious explanation can be found in the Euro crisis. After 2011 there were doubts about whether the single currency would break up. That the Italians would have to pay back their debts in Lira and the Spanish in pesetas, while the Germans would continue doing so in Euros (or perhaps in Marks, but in any case in a currency which would have much more value than that of the periphery). If it were not like that, it would be impossible to explain the differential returns on long term bonds of 4 or 5% per year, risk premia of 200, 300, 400 and 500 basic points. Premiums up to 100 points can be considered appropriate to a different perception of credit risk. But when they pass 200, and this happened after 2011, it can no longer be explained because one sovereign bond has a AAA rating and another a BBB. There is a real fear of redenomination in another currency, of devaluation.

When European interest rates normalise, European banks will recover a large part of the difference in returns lost in compared to the American banks.