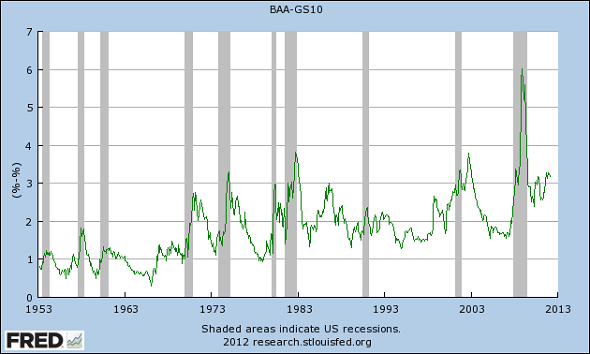

By Luis Arroyo, in Madrid | A lengthy series of the risk premium spread (over capital or liquidity) between US Treasuries and BAA corporate bonds tells us several things: 1) that each time there has been recession (gray areas) this premium has picked up markedly; 2) the time it reached the highest point was in the last recession, up to 6%; 3) the 60-year average of this spread is 1.8%; 4) the current figure (February 2012) is 3.17%, a level close to the beginning of the last two recessions, in 2000 and 2008; 5) at the start of any recovery, it is clear that the premium drops significantly until the downward cycle comes in and the spread goes up to a peak at the end of the recession that follows; 6) after the Great Recession, there have been two attempts at lowering the bar, but then, the two times, it has returned to the 3% area; 7) movements upwards and downwards are due to the Treasury bond, which goes up more often than the private bond during recovery periods, and which, in recessions, falls more than the private bond, too.

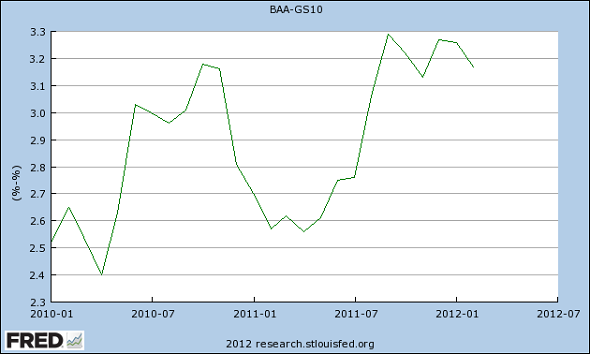

In other words, it’s a pretty good indicator, or it has been so until now, of cyclical phases. Thus, if things have not changed, I would not expect recovery to take momentum before this line falls, which so far has accompanied the upswings. It is possible, and easily verifiable, that these declines twice interrupted are linked to the euro crises. I think this appears clearer in the following chart, in which the period observed is reduced to 2010-2012:

This graph leaves no room for doubt. Clearly, the second crisis, the most recent one, has impacted more than the previous one on expectations and uncertainty. And it’s also clear that the shock has not vanished yet. The US economy is conditioned, as expected, by the euro’s mess. And the euro’s mess is far from resolved: the Spanish risk premium is on its way up again. And, last but not least, the price of oil is a great enemy of recoveries.

Be the first to comment on "Impact of euro crisis in the US economy"