From the WSJ “Economists react”:

“For the [Federal Open Market Committee], the unexpected 292,000 jobs added in December, and the upward revisions to October and November, will bolster their case for four rate hikes this year. Markets are desperate for good news, and now have it, but it comes with a caveat because better employment growth means the Fed will raise rates faster.” —Beth Ann Bovino, Standard & Poor’s Ratings Services

From Bill Gross:

“The Fed does believe that jobs and the unemployment rate is critical to future inflation over the medium term,” Gross said. “So the three or four Fed steps that Stan Fischer and Janet Yellen seem to confirm are probably on track, at least in their verbiage.”

They are right. That´s the way the Fed thinks. But it is dangerous and wrong! Insisting on the mistake will likely lead to another recession. Larry Kudlow (HT Lars Christensen) also rants on the Fed´s mistaken view.

Fed should not make policy based on labor: Kudlow

Some illustrations for the past 22 years will help identify the mistake.

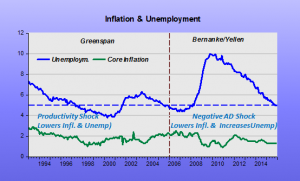

The first chart shows no connection between unemployment and inflation. While unemployment has “travelled widely”, core inflation has remained low and stable (on average below the 2% target).

Note how inflation and unemployment reacted to the productivity shock of the late 1990s. Note also how the negative AD shock of 2008 affected unemployment and inflation.

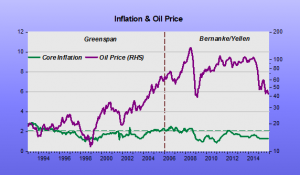

Many at the FOMC like to appeal to “special causes” for the low inflation. A favorite is oil prices. However, the next chart shows that while oil prices have “jumped & tumbled”, core inflation has remained subdued.

Note that in 2007-08 the economy was buffeted by both a negative AD shock and a negative supply (oil) shock. In that case both the AD curve and AS curve shift to the left. This solves the “puzzle” frequently mentioned of “why didn´t inflation fall even more”. The negative AS shock “supported” inflation. However, the negative AD shock was so strong that it ended up “annulling” the supply shock, with oil prices tumbling, at which point inflation dropped.

And Lacker is worried about an “inflation conundrum” (title has changed)!

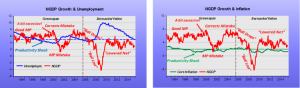

Now, let´s look at things from a NGDP perspective.

Much better, I think. The productivity shock after 1997 reduced unemployment and inflation. Keeping monetary policy (NGDP growth) steady was key to the outcome. However, in 1999/00, NGDP growth was a bit excessive and the reaction resulted in too much tightening. In 2003-05, the mistake was corrected, with unemployment falling and inflation remaining close to target.

Bernanke reacts to the oil shock by tightening monetary policy (allowing NGDP growth to fall unadvisedly (“let´s ball drop”). The mistake was compounded by “losing the ball”, after which the “net was permanently lowered” i.e. NGDP growth never rose sufficiently to take spending to the previous trend level.

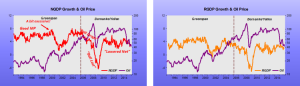

Additional information is provided by the NGDP growth, RGDP growth and oil prices:

During the first leg of the oil shock in 2002-05, monetary policy was “expansionary”, to offset the previous “tightening”. Note from the second chart from the top, that inflation remained well behaved. Despite the oil shock, real output growth rebounded. Bernanke “dropping the ball”, combined with the second leg of the oil shock, strongly decreased real growth. When the “ball was lost”, real growth tanked. The price of oil tumbled as a result of the strongly negative AD shock.

The oil shock effect on output was something about which Bernanke had written in 1997, concluding:

Substantively, our results support that an important part of the effect of oil price shocks on the economy results not from the change in oil price per se, but from the resulting tightening of monetary policy.

This finding may help explain the apparently large effects of oil price changes found by Hamilton (1983) and many others.

He certainly proved his point in 2007-08!

What the above discussions tells me is that monetary policy should not be informed by the rate of unemployment, what´s happening to oil prices or whatnot. A focus on NGDP growth relative to a “desired trend path” is all that´s needed.

The Fed seems to be making the same error again, this time by focusing on unemployment instead of oil prices.

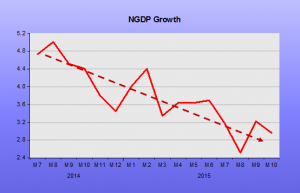

Ever since the NGDP growth “net” was brought (insufficiently) up in 2010 and until mid-2014, trend NGDP growth was close to 4%. Since then, it has trended down dangerously:

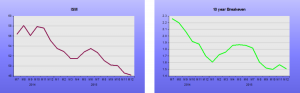

So it´s not at all surprising to see real and financial indicators also going south. Just to give two examples; the Institute of Supply Management diffusion index (ISM) and long term inflation expectations from the 10 year breakeven.

So it´s not at all surprising to see real and financial indicators also going south. Just to give two examples; the Institute of Supply Management diffusion index (ISM) and long term inflation expectations from the 10 year breakeven.

If these trends continue, and the Fed seems set on keeping them going, the likelihood of a recession will be increasing as the year progresses.

Update: Stephen King gets it right:

Conventional wisdom suggests lower oil prices should provide a shot in the arm for the global economy. In current circumstances, however, lower oil prices may simply be providing over-enthusiastic central bankers with an opportunity to shoot themselves in the foot.