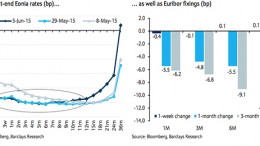

Resilient Eonia fixing, fragile long Eonia rates

LONDON | June 9, 2015 | By Giuseppe Maraffino (Barclays) | Eonia and Euribor fixings (as well as OIS rates up to 1 year) have been immune to the new round of high volatility. This is because they are more sensitive to liquidity conditions and the current abundant liquidity surplus at about EUR300bn has been an important protection.