Germany calls on EU to create joint financing instruments to counter US green plan

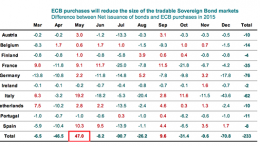

Intermoney| Despite central bank messages, the news that moved the bond market on Tuesday was German Chancellor Olaf Scholz’s request to the European Union to create joint financing instruments to counter the US green plan. Bond yields fell as investors reduced bets on the scale of monetary tightening and positioned themselves for more fiscal burden-sharing in the bloc. A slower pace of tightening is good news for Italian bonds, as…