Spain has reason to be tranquil

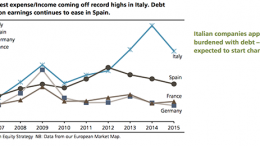

The direct impact of the global slowdown in Spain is being offset by the positive indirect effects on private consumption. High GDP growth rates will be maintained in 2015 and 2016, but these will moderate progressively, with economic growth seen falling to 2.8% from 3.1% in 2015 as reported by Bank of Spain last week.