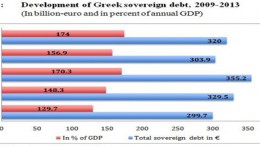

By Jens Bastian at The Agora | The two economic adjustment programmes for Greece from 2010 and 2012 as well as the sovereign debt restructuring from April 2012 and the debt buyback initiative in December of the same year have had a significant impact on the debt profile of Greece as a sovereign debtor. Greece’s creditor structure in 2013 compared to the point of departure in 2010 hardly bears any resemblance.

adjustment programmes for Greece from 2010 and 2012 as well as the sovereign debt restructuring from April 2012 and the debt buyback initiative in December of the same year have had a significant impact on the debt profile of Greece as a sovereign debtor. Greece’s creditor structure in 2013 compared to the point of departure in 2010 hardly bears any resemblance. – See more at: http://www.macropolis.gr/?i=portal.en.the-agora.672&itemId=672#sthash.BZtuYz92.dpuf

The two economic adjustment programmes for Greece from 2010 and 2012 as well as the sovereign debt restructuring from April 2012 and the debt buyback initiative in December of the same year have had a significant impact on the debt profile of Greece as a sovereign debtor. Greece’s creditor structure in 2013 compared to the point of departure in 2010 hardly bears any resemblance. – See more at: http://www.macropolis.gr/?i=portal.en.the-agora.672&itemId=672#sthash.BZtuYz92.dpuf

The two economic adjustment programmes for Greece from 2010 and 2012 as well as the sovereign debt restructuring from April 2012 and the debt buyback initiative in December of the same year have had a significant impact on the debt profile of Greece as a sovereign debtor. Greece’s creditor structure in 2013 compared to the point of departure in 2010 hardly bears any resemblance. – See more at: http://www.macropolis.gr/?i=portal.en.the-agora.672&itemId=672#sthash.BZtuYz92.dpuf

The two economic adjustment programmes for Greece from 2010 and 2012 as well as the sovereign debt restructuring from April 2012 and the debt buyback initiative in December of the same year have had a significant impact on the debt profile of Greece as a sovereign debtor. Greece’s creditor structure in 2013 compared to the point of departure in 2010 hardly bears any resemblance.

– See more at: http://www.macropolis.gr/?i=portal.en.the-agora.672&itemId=672#sthash.BZtuYz92.dpuf

The two economic adjustment programmes for Greece from 2010 and 2012 as well as the sovereign debt restructuring from April 2012 and the debt buyback initiative in December of the same year have had a significant impact on the debt profile of Greece as a sovereign debtor. Greece’s creditor structure in 2013 compared to the point of departure in 2010 hardly bears any resemblance.

– See more at: http://www.macropolis.gr/?i=portal.en.the-agora.672&itemId=672#sthash.BZtuYz92.dpuf